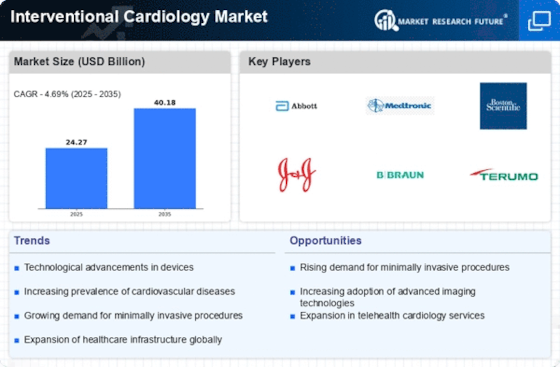

Focus on Minimally Invasive Procedures

The Interventional Cardiology Market is witnessing a pronounced shift towards minimally invasive procedures, which offer numerous advantages over traditional surgical methods. These procedures typically result in shorter recovery times, reduced hospital stays, and lower risk of complications. As patients increasingly prefer less invasive options, healthcare providers are adapting their practices to meet this demand. Data indicates that the market for minimally invasive cardiac interventions is expected to grow at a compound annual growth rate of 8% through 2027. This trend not only enhances patient satisfaction but also aligns with the broader healthcare objective of improving outcomes while minimizing costs, thereby driving the interventional cardiology market.

Rising Prevalence of Cardiovascular Diseases

The Interventional Cardiology Market is significantly influenced by the rising prevalence of cardiovascular diseases, which remain a leading cause of mortality worldwide. Factors such as sedentary lifestyles, unhealthy diets, and increasing stress levels contribute to this alarming trend. Recent statistics suggest that cardiovascular diseases account for approximately 31% of all global deaths, underscoring the urgent need for effective interventional treatments. As healthcare systems prioritize cardiovascular health, the demand for interventional cardiology procedures is expected to escalate. This growing patient population necessitates the development of innovative solutions, thereby propelling the market forward and creating opportunities for industry stakeholders.

Regulatory Support and Reimbursement Policies

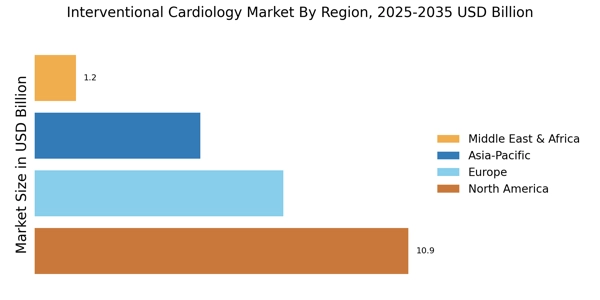

The Interventional Cardiology Market benefits from favorable regulatory support and reimbursement policies that encourage the adoption of innovative therapies. Governments and health organizations are increasingly recognizing the importance of interventional cardiology in improving patient outcomes. Enhanced reimbursement frameworks for procedures such as angioplasty and stenting are likely to stimulate market growth. Recent policy changes in several regions have expanded coverage for advanced interventional techniques, making them more accessible to patients. This supportive regulatory environment not only fosters innovation but also encourages investment in research and development, thereby propelling the interventional cardiology market forward.

Aging Population and Increased Healthcare Expenditure

The Interventional Cardiology Market is significantly impacted by the aging population, which is more susceptible to cardiovascular diseases. As life expectancy increases, the incidence of heart-related ailments rises, necessitating advanced interventional treatments. Additionally, increased healthcare expenditure in many regions facilitates access to cutting-edge cardiology services. According to projections, healthcare spending is expected to rise by 5% annually, further supporting the growth of the interventional cardiology market. This demographic shift, coupled with enhanced financial resources for healthcare, suggests a robust demand for interventional cardiology solutions, positioning the industry for sustained growth in the coming years.

Technological Advancements in Interventional Cardiology

The Interventional Cardiology Market is experiencing a surge in technological advancements that enhance procedural efficacy and patient outcomes. Innovations such as drug-eluting stents, bioresorbable stents, and advanced imaging techniques are revolutionizing treatment protocols. For instance, the introduction of 3D imaging and robotic-assisted systems has improved precision in catheter placements, thereby reducing complications. According to recent data, the market for interventional cardiology devices is projected to reach USD 30 billion by 2026, driven by these technological innovations. Furthermore, the integration of artificial intelligence in diagnostic tools is likely to streamline workflows and enhance decision-making processes, indicating a promising trajectory for the industry.