Growing Awareness and Education

There is a notable increase in public awareness regarding cardiovascular health in Germany, which serves as a catalyst for the interventional cardiology market. Educational campaigns and initiatives by health organizations have led to a better understanding of heart diseases and the importance of early intervention. This heightened awareness is likely to result in more individuals seeking medical advice and treatment, thereby increasing the demand for interventional procedures. Additionally, healthcare professionals are receiving enhanced training in the latest interventional techniques, further supporting the growth of the market. As patients become more informed, the interventional cardiology market may experience a surge in procedural demand, reflecting a proactive approach to cardiovascular health.

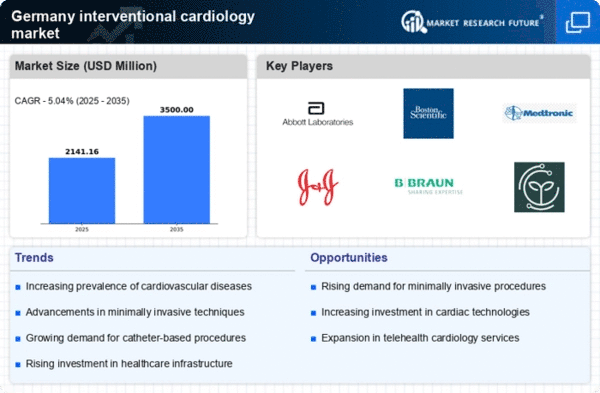

Investment in Healthcare Infrastructure

Germany's commitment to enhancing healthcare infrastructure significantly impacts the interventional cardiology market. The government has been investing heavily in modernizing hospitals and clinics, which facilitates the adoption of advanced interventional cardiology technologies. Reports indicate that healthcare expenditure in Germany is projected to reach €500 billion by 2025, with a substantial portion directed towards cardiology services. This investment not only improves patient access to cutting-edge treatments but also encourages the development of new interventional devices and techniques. As facilities upgrade their capabilities, the interventional cardiology market is poised for substantial growth, driven by improved patient outcomes and increased procedural volumes.

Technological Integration in Healthcare

The integration of advanced technologies in healthcare is transforming the interventional cardiology market in Germany. Innovations such as telemedicine, artificial intelligence, and robotic-assisted surgeries are becoming increasingly prevalent. These technologies not only improve the precision and efficiency of interventional procedures but also enhance patient safety and recovery times. The market is witnessing a shift towards minimally invasive techniques, which are often preferred by patients due to reduced recovery periods. As hospitals and clinics adopt these technologies, the interventional cardiology market is likely to expand, driven by improved procedural outcomes and patient satisfaction. The ongoing research and development in this area suggest a promising future for the market.

Regulatory Support for Medical Innovations

Regulatory bodies in Germany are actively supporting the development and approval of new medical technologies, which is beneficial for the interventional cardiology market. Streamlined approval processes and incentives for innovation encourage companies to invest in research and development. The European Medicines Agency (EMA) has been working to expedite the review of novel interventional devices, which can lead to quicker market entry. This regulatory environment fosters a culture of innovation, allowing for the introduction of advanced interventional cardiology solutions that can address unmet medical needs. As a result, the interventional cardiology market is likely to see a continuous influx of new products and technologies, enhancing treatment options for patients.

Rising Prevalence of Cardiovascular Diseases

The increasing incidence of cardiovascular diseases in Germany is a primary driver for the interventional cardiology market. According to recent health statistics, cardiovascular diseases account for approximately 40% of all deaths in the country. This alarming trend necessitates advanced interventional procedures, thereby propelling market growth. The aging population, coupled with lifestyle factors such as obesity and sedentary behavior, contributes to this rise. As healthcare providers seek to address these challenges, the demand for innovative interventional cardiology solutions is expected to escalate. Furthermore, the interventional cardiology market is likely to benefit from increased funding and resources allocated to cardiovascular health initiatives, enhancing the overall treatment landscape.