Investment in Healthcare Infrastructure

Japan's commitment to enhancing its healthcare infrastructure significantly impacts the interventional cardiology market. The government has allocated substantial funding to modernize hospitals and clinics, ensuring they are equipped with the latest medical technologies. This investment is crucial for the adoption of advanced interventional cardiology techniques, which require specialized equipment and facilities. Furthermore, the establishment of dedicated cardiac care centers across the nation is expected to improve access to interventional procedures. As a result, the interventional cardiology market is poised for growth, with an anticipated increase in the number of procedures performed annually, potentially reaching over 500,000 by 2026.

Rising Prevalence of Cardiovascular Diseases

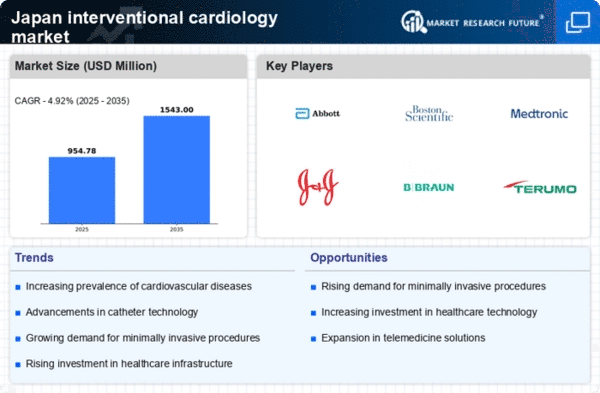

The increasing incidence of cardiovascular diseases in Japan is a primary driver for the interventional cardiology market. According to recent health statistics, cardiovascular diseases account for approximately 30% of all deaths in the country. This alarming trend necessitates advanced interventional procedures, such as angioplasty and stenting, to manage and treat these conditions effectively. The demand for innovative treatment options is further fueled by the growing awareness of heart health among the population. As healthcare providers strive to improve patient outcomes, the interventional cardiology market is likely to experience substantial growth, with projections indicating a compound annual growth rate (CAGR) of around 8% over the next five years.

Technological Innovations in Medical Devices

Technological innovations play a pivotal role in driving the interventional cardiology market. The introduction of advanced medical devices, such as drug-eluting stents and bioresorbable scaffolds, has revolutionized treatment options for cardiovascular diseases. These innovations enhance the efficacy of interventional procedures and reduce the risk of complications. Furthermore, the integration of artificial intelligence and robotics in cardiac interventions is expected to improve precision and outcomes. As Japan continues to invest in research and development, the interventional cardiology market is likely to benefit from a steady influx of new technologies, potentially increasing market value by over $1 billion by 2027.

Growing Demand for Minimally Invasive Procedures

The shift towards minimally invasive procedures is reshaping the interventional cardiology market in Japan. Patients increasingly prefer treatments that offer quicker recovery times and reduced hospital stays. Techniques such as catheter-based interventions are gaining traction, as they minimize trauma and enhance patient comfort. This trend is supported by advancements in medical technology, which have made these procedures safer and more effective. As a result, the interventional cardiology market is likely to expand, with a projected increase in the adoption of minimally invasive techniques by approximately 15% over the next few years. This shift not only benefits patients but also healthcare providers, as it can lead to lower overall healthcare costs.

Increased Awareness and Education on Heart Health

The rising awareness and education regarding heart health among the Japanese population significantly influence the interventional cardiology market. Public health campaigns and educational programs have led to a greater understanding of cardiovascular risks and the importance of early intervention. This heightened awareness encourages individuals to seek medical advice and undergo necessary procedures, thereby driving demand for interventional cardiology services. As more people recognize the benefits of timely treatment, the interventional cardiology market is expected to grow, with an estimated increase in patient referrals for interventional procedures by 20% in the coming years.