Rising Aging Population

The aging population in South America is a crucial driver for the interventional cardiology market. As individuals age, the risk of cardiovascular diseases increases significantly. According to recent data, approximately 15% of the population in South America is over 65 years old, a demographic that is expected to grow. This demographic shift necessitates advanced interventional cardiology procedures to manage age-related heart conditions. The demand for minimally invasive procedures is likely to rise, as older patients often prefer options that reduce recovery time. Consequently, healthcare providers are increasingly investing in interventional cardiology technologies to cater to this growing segment. The interventional cardiology market is thus poised for expansion, driven by the need to address the unique cardiovascular challenges faced by an aging population.

Growing Awareness and Education

There is a notable increase in awareness and education regarding cardiovascular health in South America, which serves as a significant driver for the interventional cardiology market. Public health campaigns and educational programs are being implemented to inform the population about the risks associated with cardiovascular diseases. This heightened awareness is leading to earlier diagnosis and treatment, which is essential for effective management. As more individuals seek medical attention for heart-related issues, the demand for interventional cardiology procedures is expected to rise. The interventional cardiology market is thus benefiting from a more informed public that is proactive about their cardiovascular health, resulting in increased patient volumes and a greater need for innovative treatment options.

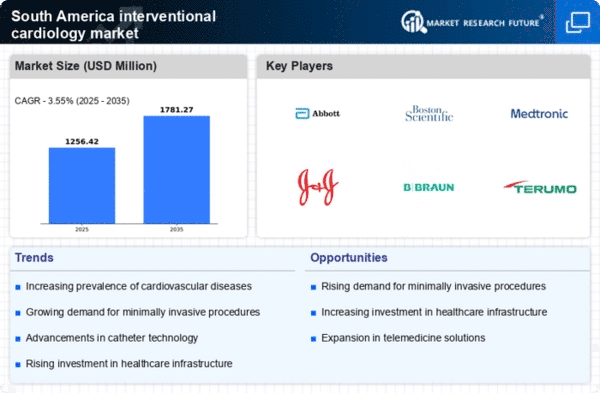

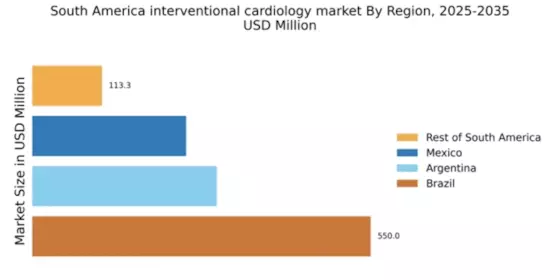

Increasing Healthcare Expenditure

Healthcare expenditure in South America has been on the rise, which positively impacts the interventional cardiology market. Governments and private sectors are allocating more funds towards healthcare infrastructure and advanced medical technologies. For instance, healthcare spending in countries like Brazil and Argentina has increased by over 10% in recent years. This financial commitment enables hospitals and clinics to invest in state-of-the-art interventional cardiology equipment and training for healthcare professionals. As a result, the interventional cardiology market is likely to experience growth, as improved access to advanced treatments becomes available to a larger segment of the population. Enhanced funding also supports research and development initiatives, further driving innovation in the field.

Regulatory Framework Enhancements

The regulatory framework surrounding medical devices and procedures in South America is evolving, which positively influences the interventional cardiology market. Governments are streamlining approval processes for new technologies, making it easier for innovative products to enter the market. This regulatory support encourages manufacturers to invest in research and development, leading to the introduction of advanced interventional cardiology devices. As a result, healthcare providers gain access to a wider range of treatment options, ultimately benefiting patients. The interventional cardiology market is thus likely to see growth as regulatory enhancements facilitate the adoption of new technologies, ensuring that patients receive the most effective and up-to-date care.

Technological Integration in Healthcare

The integration of advanced technologies in healthcare is transforming the interventional cardiology market in South America. Innovations such as telemedicine, artificial intelligence, and robotic-assisted surgeries are becoming more prevalent. These technologies enhance the precision and efficiency of interventional procedures, leading to better patient outcomes. For example, the use of AI in diagnostic imaging has improved the accuracy of identifying cardiovascular conditions. As healthcare facilities adopt these technologies, the interventional cardiology market is likely to expand, driven by the demand for cutting-edge solutions that improve procedural success rates. Furthermore, the ongoing development of new devices and techniques is expected to attract investment and interest from both healthcare providers and patients.