Technological Advancements

The Global Inertial Navigation System Market Industry is experiencing rapid technological advancements, particularly in miniaturization and sensor technology. Innovations in micro-electromechanical systems (MEMS) have led to the development of smaller, more efficient inertial sensors. These advancements enhance the accuracy and reliability of navigation systems across various applications, including aerospace, automotive, and marine sectors. As a result, the market is projected to reach 13.2 USD Billion in 2024, reflecting the growing demand for precise navigation solutions. The integration of artificial intelligence and machine learning into inertial navigation systems further indicates a trend towards smarter, more autonomous navigation solutions.

Growing Automotive Applications

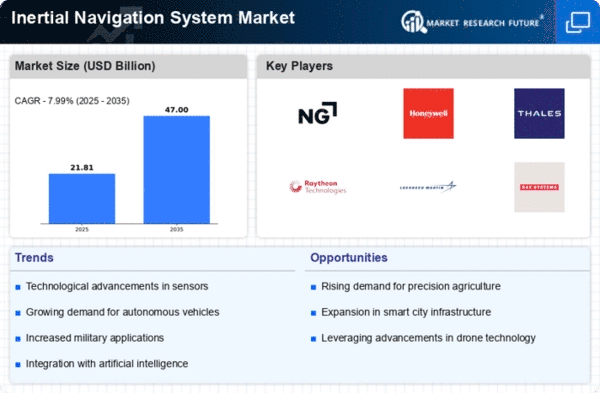

The automotive industry is increasingly adopting inertial navigation systems, contributing to the growth of the Global Inertial Navigation System Market Industry. With the rise of autonomous vehicles and advanced driver-assistance systems (ADAS), the need for reliable navigation solutions is more pronounced. Inertial navigation systems complement GPS technology, providing continuous positioning information even in GPS-denied environments. This integration is crucial for enhancing vehicle safety and navigation accuracy. As the automotive sector evolves, the market is expected to witness a compound annual growth rate (CAGR) of 4.38% from 2025 to 2035, reflecting the increasing reliance on sophisticated navigation systems.

Military and Defense Applications

The military and defense sectors are pivotal in driving the Global Inertial Navigation System Market Industry, as these systems are essential for various applications, including missile guidance, aircraft navigation, and naval operations. The need for high-precision navigation in challenging environments underscores the importance of inertial navigation systems in defense strategies. Governments worldwide are investing in advanced navigation technologies to enhance operational capabilities and ensure mission success. This focus on military applications is likely to sustain market growth, as defense budgets continue to prioritize modernization and technological advancements.

Increased Demand in Aerospace Sector

The aerospace sector significantly drives the Global Inertial Navigation System Market Industry, as the need for precise navigation and positioning systems becomes paramount. With the expansion of commercial aviation and the increasing number of unmanned aerial vehicles (UAVs), the demand for advanced inertial navigation systems is on the rise. These systems provide critical data for flight control and navigation, enhancing safety and operational efficiency. The market's growth trajectory suggests that by 2035, it could reach 21.1 USD Billion, driven by the aerospace industry's ongoing investments in next-generation navigation technologies.

Emerging Markets and Global Expansion

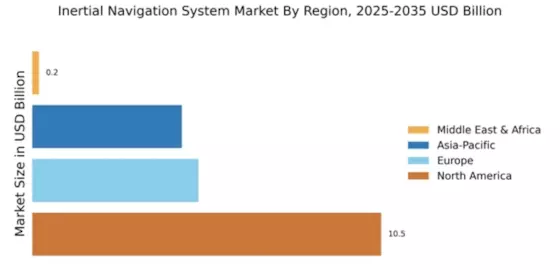

Emerging markets are playing a crucial role in the expansion of the Global Inertial Navigation System Market Industry. Countries in Asia-Pacific, Latin America, and the Middle East are witnessing increased investments in infrastructure and technology, driving demand for advanced navigation systems. As these regions develop their aerospace, automotive, and defense sectors, the need for reliable inertial navigation solutions becomes more pronounced. This trend suggests a potential for significant market growth, as global players seek to establish a presence in these burgeoning markets, further contributing to the overall expansion of the industry.