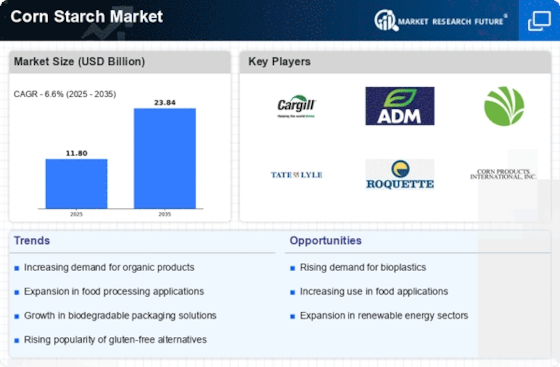

Expansion in Bioplastics

The Corn Starch Market is witnessing a transformative shift towards bioplastics, as environmental concerns prompt manufacturers to seek sustainable alternatives to conventional plastics. Corn starch serves as a renewable feedstock for producing biodegradable plastics, which are increasingly favored in packaging applications. In 2025, the bioplastics segment is projected to capture a significant share of the corn starch market, driven by regulatory pressures and consumer demand for eco-friendly products. This transition not only aligns with sustainability goals but also opens new avenues for growth within the Corn Starch Market, as companies innovate to develop high-performance bioplastics that meet diverse industry requirements.

Rising Demand in Food Industry

The Corn Starch Market experiences a notable surge in demand from the food sector, driven by the increasing utilization of corn starch as a thickening agent, stabilizer, and texturizer in various food products. In 2025, the food industry accounts for approximately 60% of the total corn starch consumption, reflecting a growing preference for natural and clean-label ingredients. This trend is further supported by the rising consumer awareness regarding health and nutrition, leading manufacturers to incorporate corn starch in gluten-free and low-calorie products. The versatility of corn starch in applications such as sauces, soups, and baked goods enhances its appeal, suggesting a robust growth trajectory for the Corn Starch Market in the food segment.

Growth in Non-Food Applications

The Corn Starch Market is experiencing significant growth in non-food applications, particularly in the pharmaceutical and personal care sectors. Corn starch is utilized as a binding agent, filler, and disintegrant in pharmaceutical formulations, contributing to the efficiency of drug delivery systems. In 2025, the pharmaceutical sector is anticipated to account for a notable share of corn starch consumption, driven by the increasing demand for generic drugs and over-the-counter medications. Additionally, the personal care industry employs corn starch in cosmetics and skincare products for its absorbent and texturizing properties. This diversification into non-food applications indicates a promising expansion trajectory for the Corn Starch Market.

Increased Focus on Clean Label Products

The Corn Starch Market is significantly influenced by the rising consumer preference for clean label products, which emphasize transparency and natural ingredients. As consumers become more discerning about food additives, corn starch is increasingly recognized for its natural origins and multifunctional properties. In 2025, the clean label trend is expected to drive a substantial portion of the corn starch market, particularly in processed foods and beverages. Manufacturers are responding by reformulating products to include corn starch as a key ingredient, thereby enhancing product appeal and meeting consumer expectations. This focus on clean label formulations is likely to propel growth within the Corn Starch Market, as brands strive to align with evolving consumer values.

Technological Innovations in Processing

Technological advancements in processing techniques are reshaping the Corn Starch Market, enhancing efficiency and product quality. Innovations such as enzymatic modification and dry-milling processes enable manufacturers to produce high-purity corn starch with tailored functional properties. These advancements are crucial in meeting the evolving demands of various applications, including food, pharmaceuticals, and textiles. In 2025, the adoption of advanced processing technologies is expected to increase, potentially leading to a more competitive landscape within the Corn Starch Market. As companies invest in research and development, the ability to create specialized corn starch products could drive market growth and expand application possibilities.