Rising Oil Prices

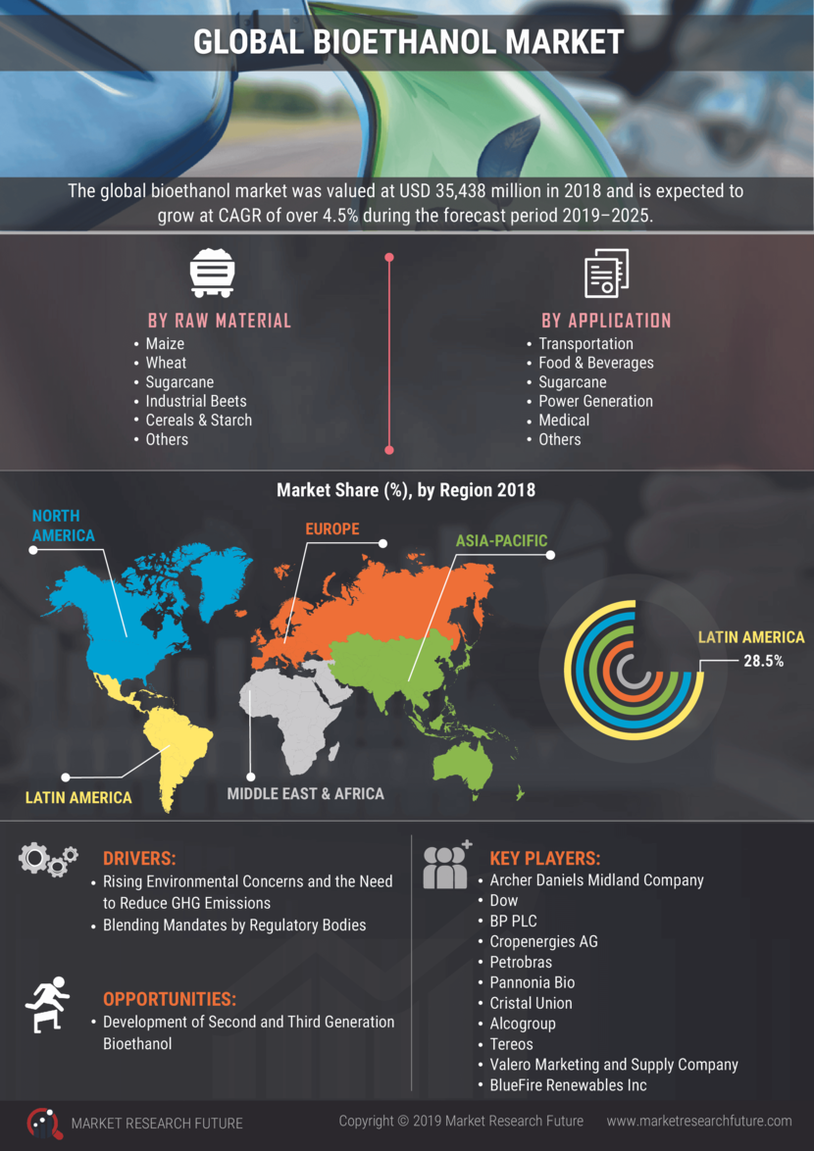

The bioethanol market is significantly influenced by fluctuations in oil prices. As crude oil prices continue to rise, the economic viability of bioethanol becomes increasingly attractive. Higher oil prices often lead to increased production costs for conventional fuels, prompting consumers and industries to seek alternative energy sources. The bioethanol market, being a renewable fuel, offers a competitive edge in such scenarios. Recent trends indicate that as oil prices soar, the demand for bioethanol has correspondingly increased, with projections suggesting a potential market growth rate of 5% annually over the next five years. This dynamic creates a favorable environment for bioethanol producers, as they can capitalize on the shift towards more sustainable fuel options amidst rising fossil fuel costs.

Supportive Government Policies

The Bioethanol Market is bolstered by supportive government policies aimed at promoting renewable energy sources. Many countries are implementing regulations and incentives to encourage the production and use of biofuels, including bioethanol. These policies often include tax credits, subsidies, and mandates for blending bioethanol with gasoline. For example, several nations have set ambitious targets for renewable energy adoption, which directly impacts the bioethanol market. Recent data suggests that countries with robust biofuel policies have seen a 30% increase in bioethanol production over the past few years. This regulatory support not only stimulates market growth but also fosters investment in bioethanol infrastructure, paving the way for a more sustainable energy future.

Increasing Environmental Awareness

The Bioethanol Market is experiencing a surge in demand driven by heightened environmental awareness among consumers and businesses. As climate change concerns escalate, stakeholders are increasingly seeking sustainable alternatives to fossil fuels. The bioethanol market, derived from renewable resources, presents a viable solution to reduce greenhouse gas emissions. According to recent data, the use of biofuels, including bioethanol, has the potential to lower carbon emissions by up to 80% compared to traditional gasoline. This growing consciousness is prompting governments and organizations to invest in bioethanol production, thereby expanding the market. Furthermore, educational campaigns and advocacy for cleaner energy sources are likely to bolster consumer acceptance and adoption of bioethanol, reinforcing its position in the energy sector.

Growing Transportation Sector Demand

The Bioethanol Market is experiencing increased demand from the transportation sector, which is a major consumer of biofuels. As the global transportation industry seeks to reduce its carbon footprint, bioethanol emerges as a viable alternative to traditional fuels. The shift towards cleaner transportation options is evident, with many automotive manufacturers developing vehicles compatible with bioethanol blends. Recent statistics indicate that bioethanol consumption in the transportation sector has risen by approximately 15% in the last year alone. This trend is expected to continue, driven by consumer preferences for environmentally friendly vehicles and government initiatives promoting biofuel use. Consequently, the transportation sector's growing reliance on bioethanol is likely to propel market expansion, creating new opportunities for producers and investors alike.

Technological Advancements in Production

The Bioethanol Market is witnessing transformative changes due to technological advancements in production processes. Innovations such as enzyme technology and fermentation techniques are enhancing the efficiency and yield of bioethanol production. These advancements not only reduce production costs but also improve the overall sustainability of bioethanol as a fuel source. For instance, the introduction of second-generation bioethanol, derived from non-food biomass, is gaining traction, as it utilizes waste materials and reduces competition with food crops. This shift is expected to expand the bioethanol market, with estimates indicating that the market could reach a valuation of USD 100 billion by 2030. As technology continues to evolve, it is likely to further streamline production processes, making bioethanol an increasingly viable alternative to conventional fuels.