Rising Labor Costs

Escalating labor costs across various regions are driving the Global Industrial Automation Market Industry towards automation solutions. Companies are increasingly seeking to mitigate these costs by investing in automated systems that can perform tasks traditionally handled by human labor. This shift not only reduces operational expenses but also enhances productivity and efficiency. As a result, the market is expected to experience a compound annual growth rate of 10.23 percent from 2025 to 2035, potentially reaching 608.6 USD Billion by 2035, as businesses prioritize automation to remain competitive.

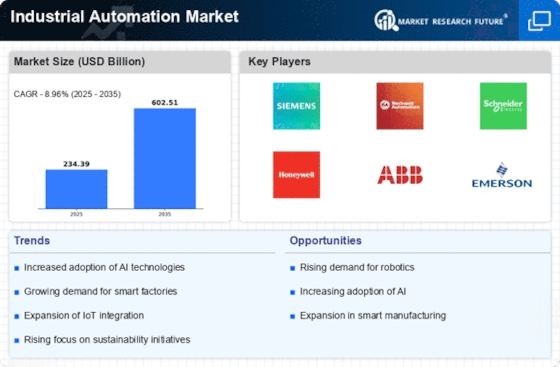

Market Growth Projections

The Global Industrial Automation Market Industry is projected to experience substantial growth, with estimates indicating a rise from 208.5 USD Billion in 2024 to 608.6 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 10.23 percent from 2025 to 2035, highlighting the increasing adoption of automation technologies across various sectors. The market's expansion is driven by factors such as technological advancements, rising labor costs, and the need for improved quality and efficiency in production processes.

Sustainability Initiatives

The Global Industrial Automation Market Industry is increasingly shaped by sustainability initiatives as companies aim to reduce their environmental impact. Automation technologies enable more efficient resource utilization, waste reduction, and energy conservation, aligning with global sustainability goals. For example, automated systems can optimize energy consumption in manufacturing processes, leading to lower carbon emissions. As regulatory pressures and consumer preferences shift towards sustainable practices, the demand for automation solutions that support these initiatives is likely to grow, further driving market expansion.

Technological Advancements

The Global Industrial Automation Market Industry is propelled by rapid technological advancements, particularly in artificial intelligence, machine learning, and the Internet of Things. These technologies enhance operational efficiency and reduce human error, leading to increased productivity. For instance, the integration of AI in manufacturing processes allows for predictive maintenance, which can reduce downtime by up to 30 percent. As companies increasingly adopt these innovations, the market is projected to reach 208.5 USD Billion in 2024, reflecting a growing reliance on automated systems to streamline operations.

Global Supply Chain Optimization

Supply chain optimization is a crucial driver of the Global Industrial Automation Market Industry. As businesses strive to enhance efficiency and reduce costs, automation plays a vital role in streamlining supply chain operations. Automated systems facilitate real-time monitoring and management of inventory, logistics, and production schedules, leading to improved responsiveness and reduced lead times. This optimization is particularly relevant in a globalized economy, where companies must adapt to fluctuating market demands. The ongoing investment in automation technologies is expected to sustain market growth as organizations seek to enhance their supply chain capabilities.

Increased Demand for Quality and Consistency

The Global Industrial Automation Market Industry is significantly influenced by the growing demand for quality and consistency in production processes. Industries such as pharmaceuticals and food and beverage require stringent quality control measures, which automation can effectively provide. Automated systems ensure that products are manufactured to precise specifications, reducing variability and enhancing overall quality. This demand for high-quality production is likely to contribute to the market's expansion, as companies invest in automation technologies to meet regulatory requirements and consumer expectations.

Leave a Comment