Integration of Big Data Technologies

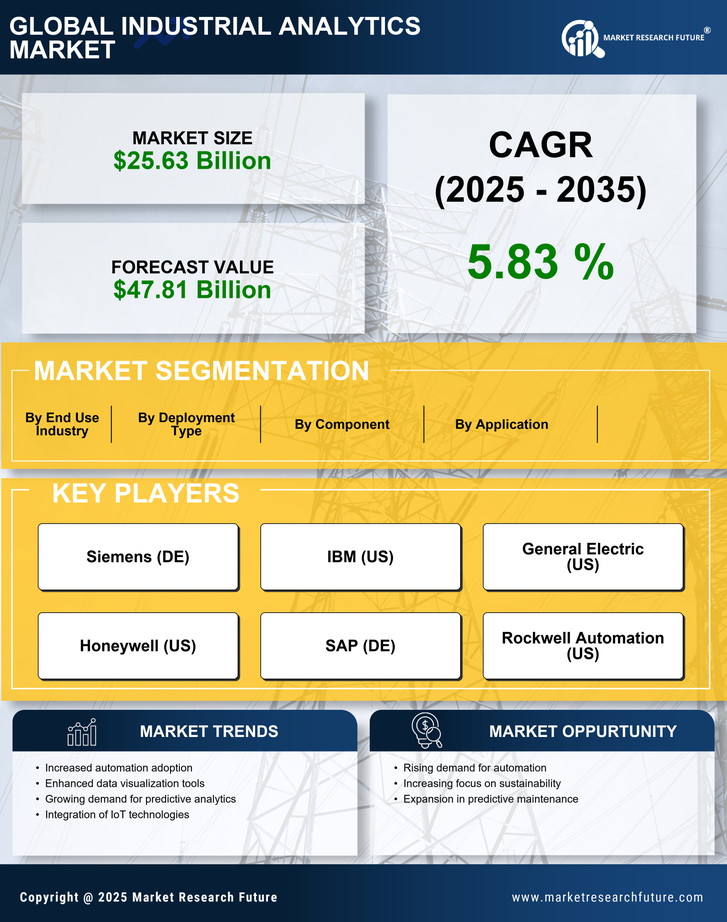

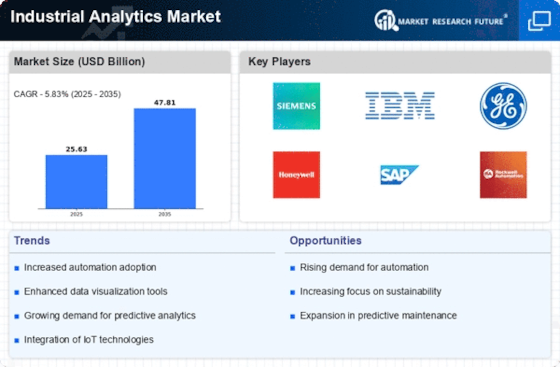

The integration of big data technologies is transforming the Industrial Analytics Market. Organizations are now able to process vast amounts of data generated from various sources, including sensors, machines, and supply chains. This capability allows for deeper insights and more informed decision-making. The market for big data analytics in industrial applications is projected to reach USD 34 billion by 2026, indicating a strong growth trajectory. Companies that harness big data analytics can uncover patterns and trends that were previously hidden, leading to improved operational strategies and enhanced customer experiences. As a result, the Industrial Analytics Market is likely to see increased investment in big data solutions, further driving its expansion.

Advancements in Predictive Maintenance

Predictive maintenance has emerged as a critical driver within the Industrial Analytics Market. By leveraging data analytics, organizations can anticipate equipment failures before they occur, thereby minimizing downtime and maintenance costs. The ability to predict when machinery requires servicing can lead to a reduction in maintenance expenses by as much as 30%. This proactive approach not only enhances operational efficiency but also extends the lifespan of equipment. As industries increasingly adopt IoT devices and sensors, the volume of data available for analysis continues to grow, further fueling the demand for predictive maintenance solutions. Consequently, the Industrial Analytics Market is likely to witness a robust expansion as companies prioritize maintenance strategies that rely on data-driven insights.

Rising Demand for Operational Efficiency

The Industrial Analytics Market experiences a notable surge in demand for operational efficiency across various sectors. Companies are increasingly seeking to optimize their processes, reduce waste, and enhance productivity. This trend is driven by the need to remain competitive in a rapidly evolving landscape. According to recent data, organizations that implement industrial analytics can achieve up to a 20% increase in operational efficiency. This growing emphasis on efficiency is likely to propel the adoption of advanced analytics solutions, as businesses recognize the potential for significant cost savings and improved performance. As a result, the Industrial Analytics Market is poised for substantial growth, with investments in analytics technologies expected to rise.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are becoming increasingly stringent across industries, driving the need for advanced analytics solutions within the Industrial Analytics Market. Companies are required to adhere to various regulations that mandate the monitoring and reporting of operational data. Analytics tools enable organizations to ensure compliance by providing real-time insights into their operations. This capability not only helps in meeting regulatory requirements but also enhances overall safety and risk management. As industries face growing scrutiny from regulatory bodies, the demand for analytics solutions that facilitate compliance is expected to rise. Consequently, the Industrial Analytics Market is likely to benefit from this trend as organizations invest in technologies that support regulatory adherence.

Growing Focus on Sustainability Initiatives

Sustainability initiatives are gaining traction within the Industrial Analytics Market as organizations strive to reduce their environmental impact. Companies are increasingly adopting analytics solutions to monitor energy consumption, waste generation, and resource utilization. This focus on sustainability is not only driven by regulatory pressures but also by consumer demand for environmentally responsible practices. According to recent studies, organizations that implement sustainability analytics can achieve a reduction in carbon emissions by up to 25%. As businesses recognize the importance of sustainable practices, the Industrial Analytics Market is expected to see a rise in the adoption of analytics tools that support sustainability goals, leading to a more responsible industrial landscape.