Market Trends

Key Emerging Trends in the Industrial Analytics Market

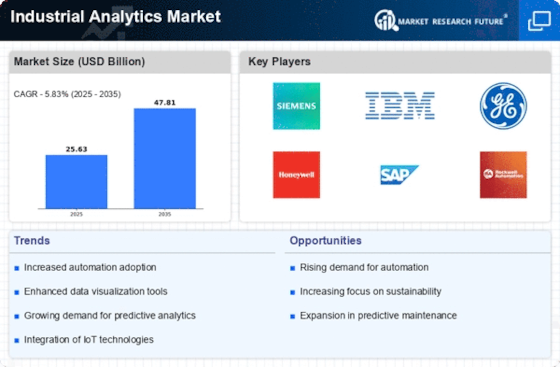

The market for industrial analytics is seeing big changes and progress as more companies understand the worth of using data insights. This makes their businesses work better and helps them make decisions. In recent times, the industrial analysis market has seen a big change to independent solutions. This shows that people now like specialized and tailored analytics tools more than before.

A big change happening is putting artifical intelligence (AI) and machine learning (ML) into tools used for analyzing industry data. This allows groups to find useful information from lots of details made by industrial activities. An important factor making the trends in the Independent Industrial Analytics Market happen is focusing on fast analytics that are done right now. As more things are connected in industries because of the Internet of Things (IoT), we need to quickly look at data. This helps us find and solve problems faster. Real-time analysis helps companies make quick decisions with data, reducing wait time and improving how they work. This change matches with the bigger movement in industries towards Industry 4.0, where computers and being connected are important for changing old ways of making things in factories and other places.

Furthermore, there is an increase in demand for cloud-based data analysis solutions within the Independent Industrial Analytics Market. Cloud technology lets businesses use tools for analyzing data without needing a lot of equipment in their offices. It makes these things able to grow, change and be reached easily from any place. This move towards using the cloud in business not just lowers costs but also makes it easy for different parts of an organization to work together and share information smoothly. The growing role of predictive analytics is another big change influencing the Independent Industrial Analytics Market. Companies are more and more using forecasting to guess when tools will break, plan maintenance times better, and reduce unexpected shutdowns. This preventive method for upkeep improves how well machines work and helps save money. So, predictive analytics is now very important for industrial data analysis. It lets companies change from just reacting to actively caring for their machines and tools ahead of time.

Leave a Comment