Focus on Workforce Skill Development

The industrial analytics market in Canada is also influenced by a growing focus on workforce skill development. As organizations adopt advanced analytics tools, there is a pressing need for skilled professionals who can interpret data and derive actionable insights. This demand for talent is prompting educational institutions and training programs to adapt their curricula to include data analytics and related fields. The Canadian government has recognized this need and is investing in initiatives aimed at enhancing the skill sets of the workforce. By 2025, it is anticipated that the demand for data analysts in the industrial sector will increase by over 20%. This emphasis on skill development is crucial for ensuring that the workforce is equipped to leverage the capabilities of the industrial analytics market effectively.

Growing Emphasis on Cybersecurity Measures

As the industrial analytics market in Canada expands, there is a growing emphasis on cybersecurity measures to protect sensitive data. With the increasing interconnectivity of devices and systems, the risk of cyber threats has escalated, prompting organizations to prioritize data security. Investments in cybersecurity solutions are projected to reach $3 billion by 2026, reflecting the critical need for robust protection mechanisms. Companies are implementing advanced security protocols to safeguard their analytics platforms and ensure compliance with regulatory standards. This focus on cybersecurity not only protects valuable data but also fosters trust among stakeholders, thereby enhancing the overall credibility of the industrial analytics market. As organizations navigate the complexities of digital transformation, the integration of strong cybersecurity measures will be essential for sustainable growth.

Increased Investment in Smart Manufacturing

The industrial analytics market in Canada is benefiting from increased investment in smart manufacturing initiatives. As industries strive to modernize their operations, there is a growing emphasis on integrating advanced analytics into manufacturing processes. This shift is expected to enhance productivity and reduce operational costs. Recent reports suggest that investments in smart manufacturing technologies could exceed $5 billion by 2027, highlighting the potential for growth in the industrial analytics market. Companies are increasingly adopting IoT devices and analytics platforms to monitor production in real-time, enabling them to make data-driven adjustments swiftly. This trend not only improves efficiency but also supports sustainability efforts by minimizing waste and energy consumption, thereby reinforcing the importance of analytics in the evolving manufacturing landscape.

Advancements in Machine Learning Technologies

Technological advancements in machine learning are significantly influencing the industrial analytics market in Canada. The integration of sophisticated algorithms and predictive analytics tools allows organizations to analyze vast amounts of data with unprecedented accuracy. This capability not only enhances operational efficiency but also facilitates proactive maintenance strategies, reducing equipment failures and associated costs. The market for machine learning in industrial analytics is expected to reach approximately $1 billion by 2026, reflecting a growing recognition of its potential. As companies seek to optimize their processes and improve product quality, the adoption of machine learning technologies is likely to accelerate. This trend indicates a shift towards more intelligent systems that can learn from data patterns, ultimately driving innovation within the industrial analytics market.

Rising Demand for Data-Driven Decision Making

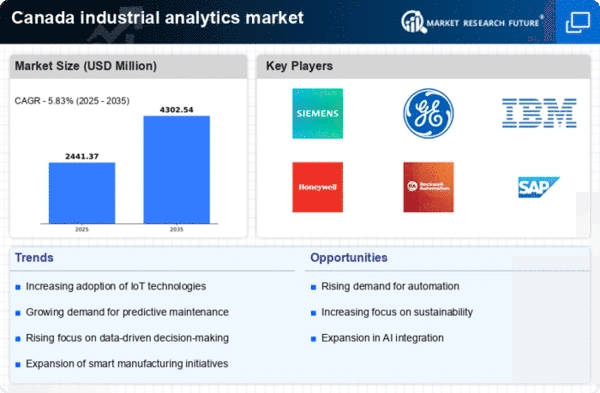

The industrial analytics market in Canada is experiencing a notable surge in demand for data-driven decision-making. Organizations are increasingly recognizing the value of leveraging data analytics to enhance operational efficiency and optimize resource allocation. According to recent estimates, the market is projected to grow at a CAGR of approximately 15% over the next five years. This growth is driven by the need for real-time insights that can inform strategic decisions, reduce downtime, and improve overall productivity. As industries such as manufacturing and energy embrace digital transformation, the reliance on advanced analytics tools becomes paramount. Consequently, the industrial analytics market is positioned to play a crucial role in enabling companies to harness the power of their data, thereby fostering a culture of informed decision making across various sectors.