Adoption of Cloud-Based Solutions

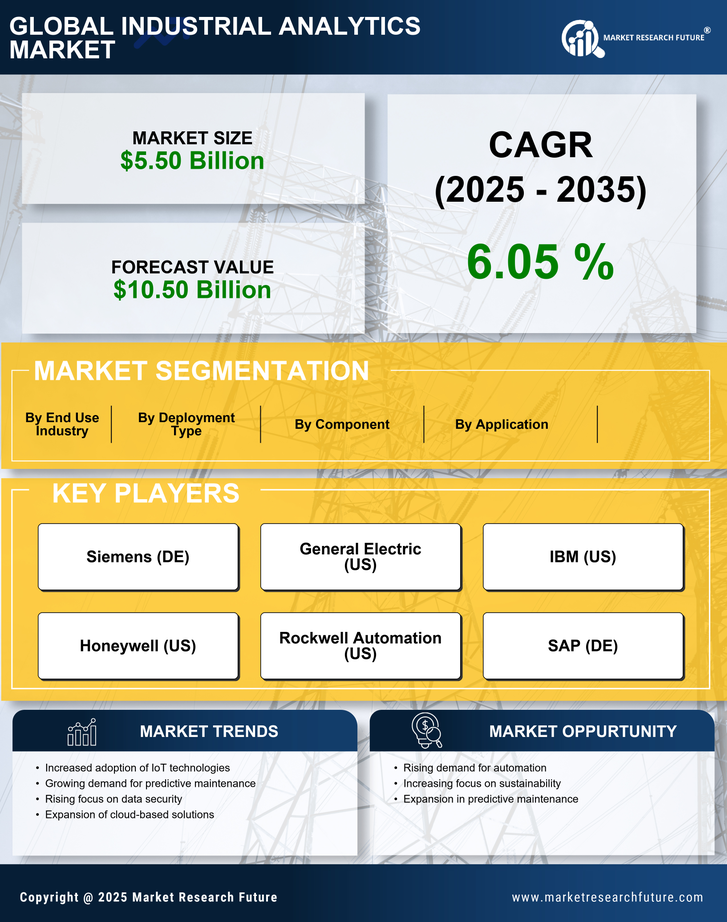

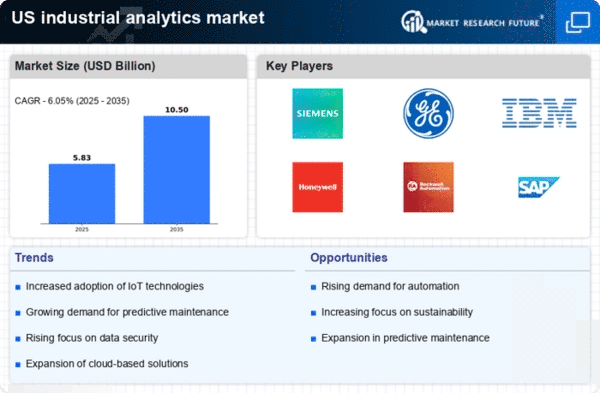

The shift towards cloud-based solutions is significantly influencing the industrial analytics market. Cloud technology offers scalability, flexibility, and cost-effectiveness, making it an attractive option for businesses looking to harness the power of analytics without heavy upfront investments. As of November 2025, it is estimated that over 60% of organizations in the manufacturing sector are utilizing cloud-based analytics platforms. This trend allows for easier data integration and collaboration across departments, fostering a more data-driven culture. The industrial analytics market is poised to expand as more companies transition to cloud solutions, enabling them to leverage advanced analytics capabilities.

Rising Demand for Predictive Maintenance

The industrial analytics market is experiencing a notable surge in demand for predictive maintenance solutions. This trend is driven by the need for manufacturers to minimize downtime and enhance operational efficiency. By leveraging advanced analytics, companies can predict equipment failures before they occur, thereby reducing maintenance costs by up to 30%. The integration of predictive maintenance tools within the industrial analytics market allows organizations to optimize their asset management strategies, leading to improved productivity and reduced operational risks. As industries increasingly adopt IoT technologies, the reliance on data-driven insights for maintenance decisions is expected to grow, further propelling the industrial analytics market.

Increased Focus on Operational Efficiency

Operational efficiency remains a critical driver for the industrial analytics market. Companies are increasingly seeking ways to streamline processes and reduce waste, which can lead to substantial cost savings. According to recent studies, organizations that implement analytics-driven strategies can achieve efficiency improvements of 15-20%. This focus on efficiency is prompting investments in analytics tools that provide real-time insights into production processes, supply chain management, and resource allocation. As businesses strive to remain competitive, the industrial analytics market is likely to see continued growth as firms prioritize data analytics to enhance their operational frameworks.

Regulatory Compliance and Risk Management

Regulatory compliance is becoming increasingly stringent across various industries, driving the need for robust analytics solutions. The industrial analytics market is responding to this demand by providing tools that help organizations monitor compliance and manage risks effectively. Companies are investing in analytics to ensure adherence to regulations, which can mitigate potential fines and legal issues. It is projected that the market for compliance analytics will grow by approximately 25% over the next few years. This focus on compliance not only enhances operational integrity but also positions organizations favorably in the eyes of stakeholders, thereby boosting the industrial analytics market.

Emergence of Advanced Data Visualization Tools

The rise of advanced data visualization tools is transforming the landscape of the industrial analytics market. These tools enable organizations to interpret complex data sets more intuitively, facilitating better decision-making processes. As visual analytics becomes more prevalent, it is estimated that the market for these tools will grow by 30% in the coming years. By providing clear and actionable insights, data visualization tools enhance the ability of businesses to identify trends, monitor performance, and optimize operations. This trend is likely to drive further adoption of analytics solutions, reinforcing the growth trajectory of the industrial analytics market.