Market Trends

Key Emerging Trends in the Indoor Positioning Navigation System Market

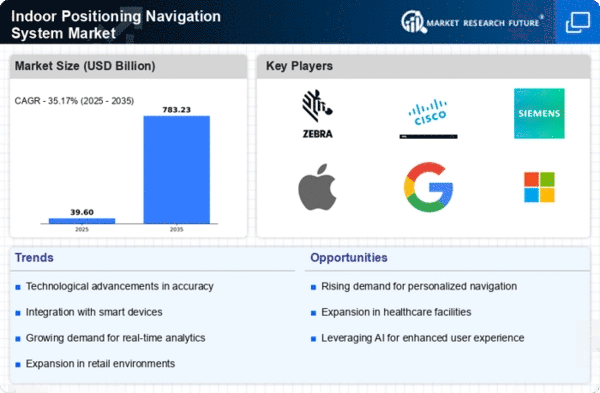

The Indoor Positioning and Navigation System (IPNS) industry is dynamic and fast growing, improving location-based services in confined environments. As more sectors use IPNS, corporations are using novel positioning techniques to gain market share.

Technology differentiation is a common IPNS tactic. Companies produce cutting-edge indoor positioning technology for accuracy and reliability. These firms spend in R&D to get a competitive edge and attract businesses and customers seeking the most innovative and effective indoor navigation systems. High-precision IPNS are developed by integrating BLE, Wi-Fi, and UWB technologies, giving firms a competitive edge.

Collaboration and partnerships are another market share positioning approach. To increase their reach and improve their products, IPNS companies value solid collaborations. IPNS suppliers integrate their solutions smoothly into ecosystems by working with smartphone manufacturers, building management systems, and software developers. Companies may reach new customers and gain a competitive edge by delivering full and integrated indoor navigation solutions through partnerships.

Customization and scalability are crucial to IPNS market positioning strategy. Successful organizations in this industry produce adaptable, customised solutions since various sectors have varied demands. Companies offering personalized IPNS solutions portray themselves as flexible partners who can meet different customer objectives, whether it's a huge retail mall, healthcare institution, or manufacturing complex. As organizations develop, indoor positioning solutions must be scalable.

Pricing tactics are crucial to IPNS market share positioning. Companies use subscription-based, one-time licensing, or freemium pricing methods depending on their target clients and market positioning. Affordability and value must be balanced to attract a wide client base and sustain income. Trial periods or pilot programs let potential consumers try the advantages, influencing their choice.

In the competitive IPNS industry, efficient marketing and branding initiatives help gain market share. Companies spend money on brand identities that reflect reliability, innovation, and consumer happiness. Digital marketing, content production, and industry events raise awareness and build market reputation. A strong brand message differentiates organizations and builds client loyalty, strengthening their market position.

For IPNS firms, compliance with industry norms and regulations is vital. Conforming to standards assures indoor positioning system quality and dependability and builds consumer trust. Given location data's sensitivity, privacy restrictions are crucial. Security and privacy in solutions provide companies an edge in the developing indoor navigation market and make them trustworthy partners.

Leave a Comment