Rise of Remote Work and Learning

The shift towards remote work and learning has significantly impacted the Wi-Fi 7 Market. As organizations and educational institutions adapt to hybrid models, the demand for reliable and high-speed internet connectivity has intensified. Wi-Fi 7 offers improved performance in congested environments, making it an attractive option for homes and offices where multiple devices are in use. The market for remote work solutions is expected to grow at a compound annual growth rate of approximately 20% over the next few years, indicating a robust opportunity for Wi-Fi 7 adoption. This trend suggests that the Wi-Fi 7 Market will likely benefit from the ongoing need for seamless connectivity, enabling efficient communication and collaboration among remote teams and students.

Growing Need for Enhanced Bandwidth

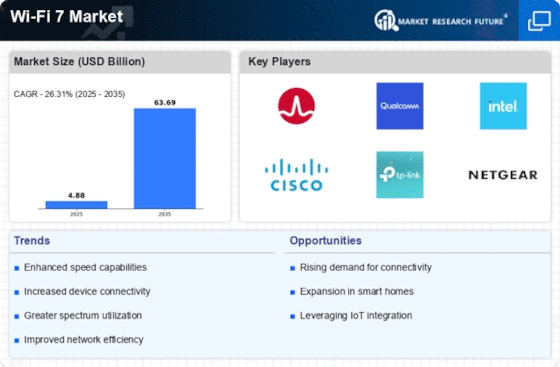

The Wi-Fi 7 Market is experiencing a notable surge in demand for enhanced bandwidth, driven by the proliferation of data-intensive applications. As more devices connect to networks, the requirement for higher data rates becomes increasingly critical. Wi-Fi 7, with its potential to deliver speeds up to 46 Gbps, appears to be a solution to this challenge. This capability is particularly relevant in environments such as offices and educational institutions, where multiple users engage in high-bandwidth activities simultaneously. According to recent estimates, the demand for bandwidth is projected to increase by over 50% in the next few years, further emphasizing the necessity for advanced Wi-Fi technologies. Consequently, the Wi-Fi 7 Market is poised for substantial growth as organizations seek to upgrade their infrastructure to accommodate these evolving needs.

Advancements in Network Security Features

As cybersecurity threats continue to evolve, the Wi-Fi 7 Market is likely to benefit from advancements in network security features. Wi-Fi 7 introduces enhanced security protocols that address vulnerabilities present in previous generations. This focus on security is crucial for businesses and consumers alike, as data breaches can have severe consequences. The market for network security solutions is projected to grow at a rate of approximately 15% annually, indicating a strong demand for secure connectivity options. Consequently, the Wi-Fi 7 Market may see increased adoption as organizations prioritize secure wireless networks to protect sensitive information and maintain user trust.

Emergence of Smart Cities and Infrastructure

The development of smart cities is a key driver for the Wi-Fi 7 Market. As urban areas increasingly integrate technology into their infrastructure, the demand for robust wireless connectivity becomes essential. Wi-Fi 7 can support a multitude of connected devices, facilitating the implementation of smart solutions such as traffic management systems, public safety networks, and environmental monitoring. The smart city market is anticipated to grow significantly, with investments expected to exceed 1 trillion dollars by 2025. This growth presents a substantial opportunity for the Wi-Fi 7 Market, as municipalities and organizations seek to enhance their connectivity solutions to support these innovative initiatives.

Increased Adoption of 8K Streaming and Gaming

The Wi-Fi 7 Market is witnessing a surge in demand due to the increasing adoption of 8K streaming and high-definition gaming. As content providers and gaming companies enhance their offerings, the need for faster and more reliable internet connections becomes paramount. Wi-Fi 7's capabilities, including lower latency and higher throughput, make it particularly suitable for these applications. The gaming industry alone is projected to reach a market value of over 200 billion dollars by 2025, with a significant portion of this growth attributed to online gaming and streaming services. This trend indicates that the Wi-Fi 7 Market is likely to expand as consumers seek the best possible experience in their entertainment choices.