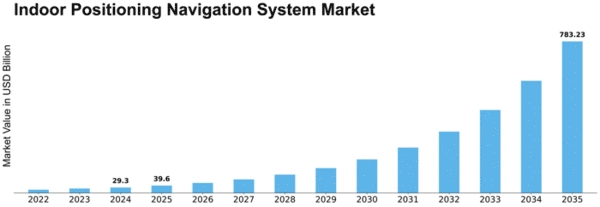

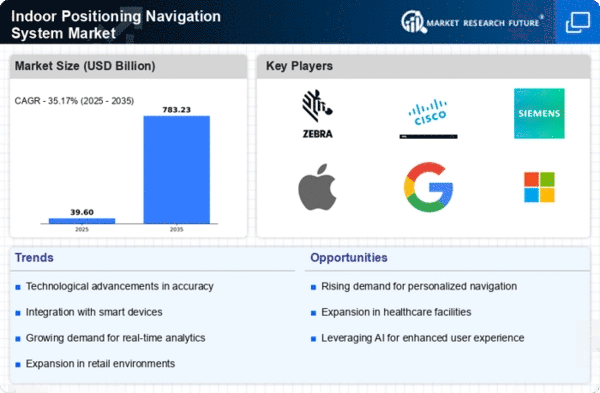

Indoor Positioning Navigation System Size

Indoor Positioning Navigation System Market Growth Projections and Opportunities

The Indoor Positioning and Navigation System (IPNS) business is changing due to technological advances and rising demand for location-based services across industries. As organizations realise the benefits of accurate indoor positioning for user experiences and operational efficiency, the worldwide IPNS market is growing.

Smartphones and other smart devices with location-based services drive market dynamics. Consumers are used to using navigation applications outdoors and expect them indoors. In retail, medical care, public transit, and other industries, accurate location information may increase consumer interaction and expedite operations, driving IPNS solution demand.

IPNS is used in retail to customize shopping, issue targeted promotions, and improve store layouts depending on user traffic. This improves the buying experience and gives businesses data for business choices. IPNS improves patient care and operational efficiency in healthcare by tracking assets, navigating patients, and optimizing workflows.

The growing deployment of IoT technologies further drives IPNS market dynamics. Precision indoor location is essential for seamless communication and coordination as more devices become linked. IPNS helps IoT devices locate themselves inside for real-time data transmission and automation in smart buildings, industries, and warehouses.

To meet rising demand, many businesses are joining the IPNS industry. Startups and established firms are developing Bluetooth-based beacons, Wi-Fi location, Ultra-Wideband (UWB), and LiDAR sensor technologies. This range of options creates a dynamic market where customers may chose solutions that fit their demands and budgets.

Government rules and standards affect IPNS market dynamics. Policymakers are prioritizing interoperability, data privacy, and security as the technology spreads. Companies deploying IPNS solutions are considering compliance with legislation and standards, altering the competitive environment and impacting buying decisions.

IPNS market prospects come with challenges. Implementing and maintaining these systems is expensive and raises privacy and data security concerns, which hinder adoption. These issues must be addressed to keep the IPNS industry growing and acquire company and consumer trust.

The COVID-19 outbreak also affected IPNS market dynamics. Social distancing and contactless solutions have increased location-based technology adoption in numerous areas. IPNS is utilized in hospitality to develop touchless check-in processes and improve client experiences, and in manufacturing to ensure safe worker distance.

IPNS market dynamics are predicted to change when 5G and AI are integrated. More precise and responsive indoor location systems will enable novel augmented reality, virtual reality, and immersive experiences."

Leave a Comment