Focus on Smart Buildings

The trend towards smart buildings in Germany is significantly influencing the indoor positioning navigation system market. As urbanization accelerates, the demand for intelligent infrastructure that enhances operational efficiency and user comfort is on the rise. Smart buildings equipped with advanced indoor navigation systems facilitate better space utilization and energy management. For instance, the German government has initiated several smart city projects aimed at integrating IoT technologies, which include indoor positioning systems. These initiatives are expected to drive the market forward, with projections indicating a potential market size increase of 30% by 2030. The focus on sustainability and energy efficiency in building design further underscores the relevance of indoor positioning technologies in modern architecture.

Increased Adoption in Retail

The retail sector in Germany is experiencing a notable shift towards the adoption of indoor positioning navigation systems, significantly impacting the market. Retailers are leveraging these systems to enhance customer experiences by providing personalized promotions and efficient store navigation. According to recent data, around 60% of major retailers in Germany have implemented some form of indoor navigation technology. This trend is likely to continue as consumers increasingly expect seamless shopping experiences. Furthermore, the integration of indoor positioning systems with mobile applications allows retailers to gather valuable insights into customer behavior, thereby optimizing inventory management and store layouts. This growing adoption is expected to contribute substantially to the overall growth of the Germany indoor positioning navigation system market.

Government Initiatives and Regulations

Government initiatives and regulations are playing a crucial role in shaping the Germany indoor positioning navigation system market. The German government has been actively promoting the development of smart technologies through various funding programs and policy frameworks. For example, the Digital Strategy 2025 aims to enhance digital infrastructure, which includes support for indoor positioning systems. Additionally, regulations concerning data privacy and security are being established to ensure consumer trust in these technologies. As businesses align with these regulations, the market is likely to see increased investment and innovation, fostering a conducive environment for growth. The anticipated increase in government support could lead to a market expansion of approximately 20% over the next few years.

Growing Demand for Enhanced User Experience

The growing demand for enhanced user experiences is a significant driver of the Germany indoor positioning navigation system market. Consumers increasingly expect intuitive and efficient navigation solutions in various environments, including shopping malls, airports, and hospitals. This demand is prompting businesses to invest in advanced indoor positioning technologies that provide real-time location information and personalized services. For instance, the integration of augmented reality (AR) with indoor navigation systems is gaining traction, offering users interactive experiences. Market data suggests that user experience-focused solutions could account for nearly 40% of the total market share by 2027. As organizations prioritize customer satisfaction, the indoor positioning navigation system market is poised for substantial growth.

Technological Advancements in Indoor Positioning

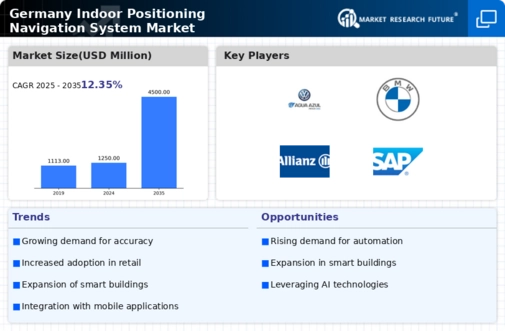

The rapid evolution of technology plays a pivotal role in the growth of the Germany indoor positioning navigation system market. Innovations in Bluetooth Low Energy (BLE), Wi-Fi, and Ultra-Wideband (UWB) technologies have enhanced the accuracy and reliability of indoor navigation systems. For instance, BLE beacons are increasingly utilized in retail environments, allowing for precise location tracking and personalized marketing strategies. The integration of artificial intelligence and machine learning algorithms further optimizes these systems, enabling real-time data analysis and improved user experiences. As a result, the market is projected to witness a compound annual growth rate (CAGR) of approximately 25% over the next five years, driven by these technological advancements.