Surge in Cardiovascular Procedures

The increasing number of cardiovascular procedures performed in India is a significant driver for the embolic protection-devices market. With a rise in conditions such as coronary artery disease and atrial fibrillation, the demand for interventions like angioplasty and stenting is escalating. Data suggests that the number of angioplasty procedures has increased by over 20% in recent years. This surge necessitates the use of embolic protection devices to mitigate the risk of embolic events during these procedures. As healthcare providers prioritize patient safety, the integration of these devices into standard practice is becoming more prevalent, thereby propelling market growth.

Technological Innovations in Device Design

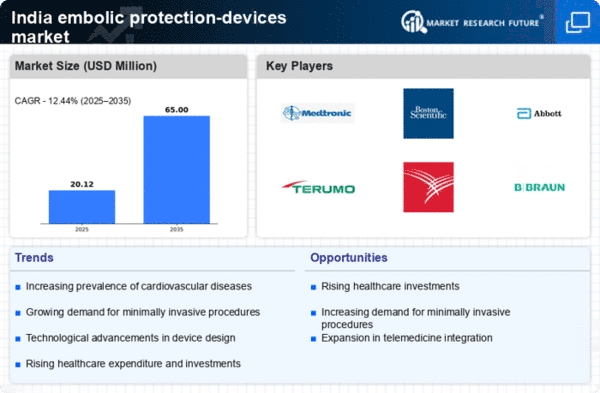

Technological innovations in the design and functionality of embolic protection devices are driving the market forward. Manufacturers are focusing on developing devices that are not only more effective but also easier to use during procedures. Innovations such as bioresorbable materials and advanced delivery systems are enhancing the performance of these devices. The introduction of next-generation embolic protection devices is expected to capture a larger market share, with projections indicating a growth rate of around 12% in the coming years. These advancements are likely to improve patient outcomes and increase the acceptance of these devices among healthcare professionals.

Rising Investment in Healthcare Infrastructure

Investment in healthcare infrastructure in India is significantly impacting the embolic protection-devices market. The government and private sectors are allocating substantial funds to enhance medical facilities, which includes the procurement of advanced medical devices. Reports indicate that healthcare expenditure in India is projected to reach $370 billion by 2025, with a notable portion directed towards cardiovascular care. This influx of capital is likely to facilitate the acquisition of embolic protection devices, thereby expanding their availability in hospitals and clinics. Enhanced infrastructure not only improves access to these devices but also fosters innovation and research in the field, further driving market growth.

Government Initiatives to Promote Medical Devices

Government initiatives aimed at promoting the medical device sector are positively influencing the embolic protection-devices market. Policies that encourage local manufacturing and reduce import duties on medical devices are fostering a conducive environment for market growth. The 'Make in India' initiative, for instance, aims to boost domestic production, which could lead to a decrease in costs and increased availability of embolic protection devices. As a result, the market may experience a compound annual growth rate (CAGR) of approximately 10% over the next few years. These initiatives not only support the growth of the market but also enhance the overall healthcare landscape in India.

Increasing Awareness of Embolic Protection Devices

The growing awareness regarding the benefits of embolic protection devices is a crucial driver for the embolic protection-devices market. Healthcare professionals and patients are becoming more informed about the risks associated with cardiovascular procedures, leading to a higher demand for protective devices. Educational campaigns and seminars conducted by medical associations have contributed to this awareness. As a result, the market is witnessing an increase in adoption rates, with estimates suggesting a growth of approximately 15% annually in device utilization. This trend indicates a shift towards preventive measures in cardiovascular interventions, thereby enhancing the overall safety of procedures and potentially reducing complications.