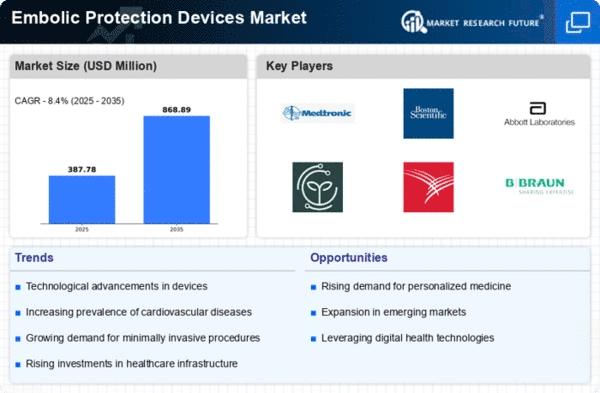

Market Growth Projections

The Global Embolic Protection Devices Market Industry is projected to experience robust growth in the coming years. With a market value of 0.36 USD Billion anticipated in 2024, the industry is expected to reach 0.87 USD Billion by 2035, reflecting a compound annual growth rate of 8.32% from 2025 to 2035. This growth trajectory indicates a strong demand for embolic protection devices, driven by factors such as technological advancements, increasing cardiovascular disease prevalence, and an aging population. The market's expansion is likely to create opportunities for innovation and investment in this critical area of healthcare.

Rising Awareness and Education

The growing awareness among healthcare professionals and patients regarding the benefits of embolic protection devices is a significant market driver. Educational initiatives and training programs are being implemented to inform stakeholders about the advantages of these devices during cardiovascular procedures. This heightened awareness is expected to contribute to the expansion of the Global Embolic Protection Devices Market Industry. As more healthcare providers recognize the importance of embolic protection, the adoption rates of these devices are likely to increase, further supporting market growth.

Increasing Geriatric Population

The global demographic shift towards an aging population is a crucial driver for the embolic protection devices market. Older adults are at a higher risk for cardiovascular diseases, necessitating the use of protective devices during surgical interventions. The Global Embolic Protection Devices Market Industry is likely to see substantial growth as the geriatric population expands. This demographic trend indicates a potential increase in market value, aligning with the projected CAGR of 8.32% from 2025 to 2035. Healthcare systems are adapting to meet the needs of this population, further supporting the demand for these devices.

Regulatory Support and Guidelines

Supportive regulatory frameworks and clinical guidelines play a pivotal role in the growth of the Global Embolic Protection Devices Market Industry. Regulatory bodies are increasingly recognizing the importance of embolic protection during cardiovascular procedures, leading to the establishment of guidelines that promote the use of these devices. This regulatory backing not only enhances the credibility of embolic protection devices but also encourages healthcare providers to adopt them in clinical practice. As a result, the market is likely to experience accelerated growth, driven by increased utilization in line with evolving clinical standards.

Rising Incidence of Cardiovascular Diseases

The increasing prevalence of cardiovascular diseases globally drives the demand for embolic protection devices. As cardiovascular conditions remain a leading cause of morbidity and mortality, the need for effective interventions becomes paramount. The Global Embolic Protection Devices Market Industry is poised to benefit from this trend, with projections indicating a market value of 0.36 USD Billion in 2024. This surge in demand is likely to be fueled by advancements in medical technology and increased awareness regarding the importance of embolic protection during procedures such as transcatheter aortic valve replacement.

Technological Advancements in Device Design

Innovations in the design and functionality of embolic protection devices significantly enhance their efficacy and safety. The integration of advanced materials and engineering techniques has led to the development of devices that are more effective in capturing embolic debris. This trend is expected to propel the Global Embolic Protection Devices Market Industry, with a projected growth to 0.87 USD Billion by 2035. The continuous evolution of these devices, including features such as improved delivery systems and biocompatibility, suggests a promising future for their adoption in clinical settings.