Growing Middle-Class Population

The expansion of the middle-class population in India is significantly influencing the dental insurance market. With an estimated 300 million individuals entering the middle class, there is a corresponding increase in disposable income, which allows for greater spending on healthcare, including dental services. This demographic shift is prompting insurance providers to tailor their offerings to meet the needs of this burgeoning market segment. As a result, the dental insurance market is projected to grow, with more families seeking comprehensive coverage to manage dental expenses. The rise in demand for dental care services is likely to drive the market further, as families prioritize health and wellness.

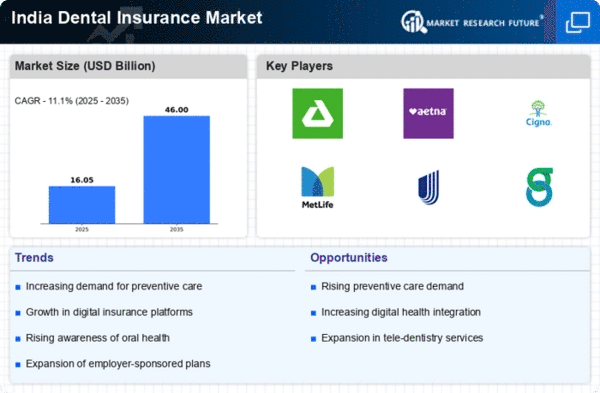

Rising Awareness of Oral Health

The increasing awareness of oral health among the Indian population is a pivotal driver for the dental insurance market. As individuals become more informed about the importance of dental hygiene and its impact on overall health, the demand for dental insurance products is likely to rise. Reports indicate that nearly 70% of urban Indians are now prioritizing dental care, leading to a surge in insurance uptake. This trend is further supported by educational campaigns and initiatives by health organizations, which emphasize the necessity of regular dental check-ups. Consequently, the dental insurance market is expected to expand as more individuals seek coverage for preventive and restorative dental services.

Increase in Dental Treatment Costs

The rising costs associated with dental treatments are a significant driver for the dental insurance market. As dental procedures become more advanced and specialized, the expenses incurred by patients are also increasing. Reports suggest that the average cost of dental treatments in urban areas has risen by approximately 15% over the past few years. This trend is prompting individuals to seek insurance coverage to mitigate out-of-pocket expenses. As awareness of these rising costs spreads, more consumers are likely to invest in dental insurance plans, thereby propelling the growth of the dental insurance market.

Government Initiatives and Policies

Government initiatives aimed at improving healthcare access are playing a crucial role in shaping the dental insurance market. Policies that promote health insurance coverage, including dental care, are being implemented to enhance public health outcomes. For instance, the Ayushman Bharat scheme aims to provide health insurance to economically vulnerable populations, which may include dental services. Such initiatives are expected to increase the penetration of dental insurance in India, as more individuals gain access to affordable coverage. The dental insurance market is likely to benefit from these policies, as they encourage preventive care and reduce the financial burden of dental treatments.

Technological Advancements in Dental Care

Technological advancements in dental care are transforming the landscape of the dental insurance market. Innovations such as teledentistry and digital diagnostics are making dental services more accessible and efficient. As these technologies become more prevalent, insurance providers are likely to adapt their policies to cover new treatment modalities. The integration of technology in dental practices not only enhances patient experience but also encourages more individuals to seek insurance coverage. Consequently, the dental insurance market is expected to grow as technology-driven solutions become integral to dental care, appealing to a tech-savvy population.