Impact of Aging Population

The demographic shift towards an aging population in Italy is poised to have a profound effect on the dental insurance market. As the population ages, there is an increased prevalence of dental issues, necessitating more frequent and specialized care. This demographic trend suggests that older adults will require more comprehensive dental coverage, which may lead to a surge in demand for tailored insurance products. By 2025, it is projected that individuals aged 65 and older will represent a significant portion of the insured population, thereby shaping the offerings within the dental insurance market to cater to their specific needs.

Rising Awareness of Oral Health

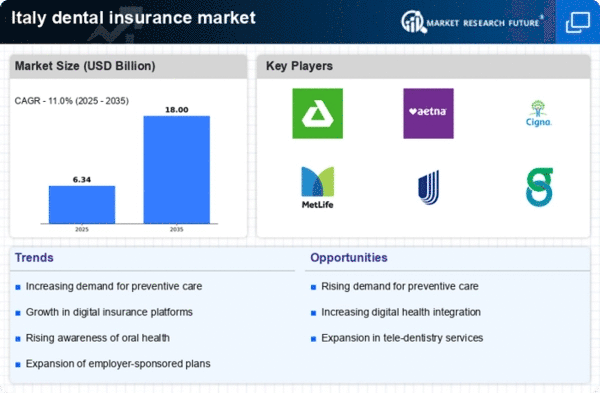

The dental insurance market in Italy is experiencing a notable increase in consumer awareness regarding oral health. This heightened consciousness is likely driven by educational campaigns and the growing recognition of the link between oral health and overall well-being. As individuals become more informed about the importance of regular dental check-ups and preventive care, the demand for dental insurance products is expected to rise. In 2025, approximately 60% of Italians are anticipated to prioritize dental coverage as part of their health insurance plans. This trend suggests that the dental insurance market will continue to expand as consumers seek to reduce out-of-pocket costs associated with dental treatments.

Technological Advancements in Dentistry

The integration of advanced technologies in dental practices is significantly influencing the dental insurance market in Italy. Innovations such as teledentistry, digital imaging, and AI-driven diagnostics are enhancing patient experiences and treatment outcomes. As these technologies become more prevalent, insurance providers may adapt their offerings to cover new procedures and services. For instance, the adoption of teledentistry is projected to increase by 25% in the coming years, prompting insurers to develop policies that encompass these modern practices. Consequently, the dental insurance market is likely to evolve, reflecting the changing landscape of dental care and the need for comprehensive coverage.

Growing Demand for Comprehensive Coverage

There is a discernible shift in consumer preferences towards comprehensive dental insurance plans in Italy. Individuals are increasingly seeking policies that cover a wider range of services, including orthodontics, cosmetic procedures, and preventive care. This trend is indicative of a broader understanding of the value of dental health, leading to a potential increase in policy uptake. In 2025, it is estimated that around 45% of new insurance policies will include extensive coverage options. This growing demand for comprehensive plans is likely to drive competition among insurers, thereby influencing the overall dynamics of the dental insurance market.

Regulatory Developments in Health Insurance

Recent regulatory changes in Italy are influencing the dental insurance market by establishing new standards for coverage and consumer protection. These developments may include mandates for insurers to offer specific dental services or to enhance transparency in policy terms. As regulations evolve, insurance providers will need to adapt their products to comply with these requirements, potentially leading to an increase in the number of individuals seeking dental insurance. The regulatory landscape is expected to continue shaping the market, ensuring that consumers have access to essential dental care services.