Rising Awareness of Oral Health

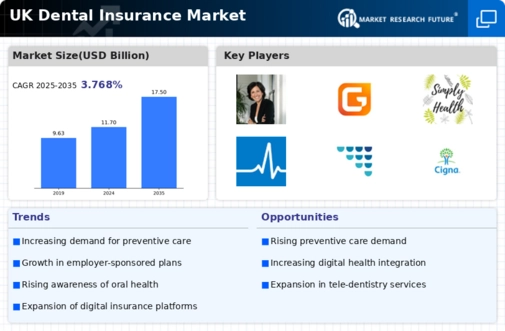

The increasing awareness of oral health among the UK population appears to be a significant driver for the dental insurance market. As individuals become more informed about the importance of dental hygiene and its impact on overall health, the demand for dental insurance products is likely to rise. Reports indicate that nearly 70% of adults in the UK recognize the necessity of regular dental check-ups, which correlates with a growing inclination to secure insurance coverage. This trend suggests that consumers are more willing to invest in dental insurance as a proactive measure to maintain their oral health, thereby potentially increasing market penetration and driving growth.

Increased Competition Among Insurers

The dental insurance market is experiencing increased competition among insurers, which appears to be a driving force for innovation and improved service offerings. As more companies enter the market, they are likely to differentiate themselves through competitive pricing, enhanced coverage options, and superior customer service. This competitive landscape may lead to more affordable premiums and better value for consumers. Recent analyses indicate that the number of dental insurance providers in the UK has grown by approximately 15% over the past five years, suggesting a robust market environment. This competition could ultimately benefit consumers and stimulate growth in the dental insurance market.

Expansion of Employer-Sponsored Plans

The expansion of employer-sponsored dental insurance plans is another notable driver influencing the dental insurance market. Many employers in the UK are increasingly offering comprehensive dental benefits as part of their employee health packages. This trend is likely to enhance employee satisfaction and retention, as dental coverage is perceived as a valuable benefit. Data indicates that approximately 40% of UK employers now provide dental insurance as part of their benefits offerings, which may lead to a higher uptake of dental insurance among employees. Consequently, this expansion could stimulate growth in the dental insurance market, as more individuals gain access to coverage through their workplaces.

Demographic Shifts and Aging Population

Demographic shifts, particularly the aging population in the UK, are poised to impact the dental insurance market significantly. As the population ages, there is an increasing prevalence of dental issues that require ongoing care and treatment. The Office for National Statistics reports that by 2030, nearly 25% of the UK population will be over 65 years old, which may lead to a heightened demand for dental insurance products tailored to older adults. This demographic trend suggests that insurance providers may need to adapt their offerings to meet the specific needs of this age group, thereby driving growth in the dental insurance market.

Technological Advancements in Dental Care

Technological advancements in dental care are likely to influence the dental insurance market positively. Innovations such as teledentistry, digital imaging, and AI-driven diagnostics are transforming how dental services are delivered. These advancements not only improve patient outcomes but also enhance the efficiency of dental practices. As technology continues to evolve, insurance providers may need to adapt their policies to cover new treatments and services. The integration of technology in dental care could lead to increased demand for insurance products that encompass these modern solutions, thereby driving growth in the dental insurance market.