Rising Middle-Class Population

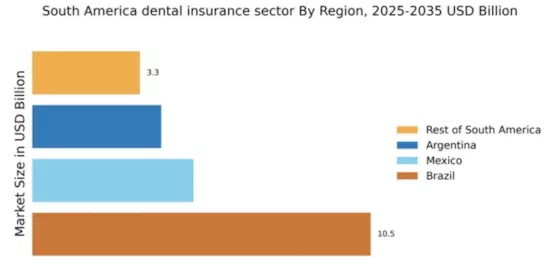

The expansion of the middle-class population in South America is a crucial driver for the dental insurance market. As economic conditions improve, more individuals are entering the middle class, which typically correlates with increased disposable income. This demographic shift suggests that a larger segment of the population may now afford dental insurance, leading to a potential increase in market size. Data indicates that the middle class in countries like Brazil and Argentina has grown by approximately 20% over the past decade. This growth is likely to result in heightened demand for dental services and insurance products, as consumers seek to protect their health and financial well-being. Consequently, the dental insurance market is poised to benefit from this demographic trend, as insurers tailor their offerings to attract this emerging consumer base.

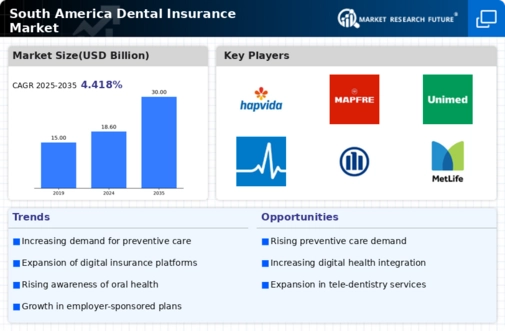

Focus on Preventive Care Services

The emphasis on preventive care services within the dental insurance market is becoming increasingly pronounced in South America. Insurers are recognizing the long-term cost benefits of preventive care, which can reduce the need for more extensive and expensive treatments. As a result, many insurance plans are now offering enhanced coverage for preventive services such as regular check-ups, cleanings, and early intervention treatments. This shift is likely to resonate with consumers who are becoming more proactive about their health. Data suggests that plans emphasizing preventive care can lead to a 30% reduction in overall dental costs for insured individuals. Therefore, the dental insurance market is expected to grow as more consumers opt for plans that prioritize preventive care, ultimately fostering a healthier population.

Increasing Awareness of Oral Health

The growing awareness of oral health among the population in South America appears to be a pivotal driver for the dental insurance market. As individuals become more informed about the importance of dental care, the demand for insurance products that cover preventive and restorative services is likely to rise. Reports indicate that approximately 60% of adults in urban areas are now prioritizing regular dental check-ups, which could lead to an increase in insurance uptake. This trend suggests that as consumers recognize the long-term benefits of maintaining oral health, they may be more inclined to invest in dental insurance plans that provide comprehensive coverage. Consequently, this heightened awareness is expected to stimulate growth within the dental insurance market, as insurers adapt their offerings to meet the evolving needs of health-conscious consumers.

Government Initiatives and Regulations

Government initiatives aimed at improving healthcare access in South America may significantly influence the dental insurance market. Various countries in the region are implementing policies to enhance public health services, including dental care. For instance, some governments are subsidizing dental insurance premiums for low-income families, which could potentially increase market penetration. Additionally, regulatory frameworks that mandate dental coverage in health insurance plans may further drive demand. As a result, the dental insurance market is likely to experience growth as more individuals gain access to affordable dental care options. This regulatory support not only encourages consumers to seek insurance but also compels insurers to innovate and expand their product offerings to comply with new standards.

Technological Advancements in Dental Care

Technological advancements in dental care are likely to have a profound impact on the dental insurance market in South America. Innovations such as teledentistry and digital diagnostics are transforming how dental services are delivered, making them more accessible and efficient. As these technologies become more prevalent, consumers may seek insurance plans that cover these modern services. For instance, the integration of AI in diagnostics could lead to more accurate treatment plans, which may increase the perceived value of dental insurance. The dental insurance market must adapt to these changes by incorporating coverage for new technologies, thereby appealing to tech-savvy consumers. This shift not only enhances service delivery but also encourages individuals to invest in insurance that aligns with contemporary dental practices.