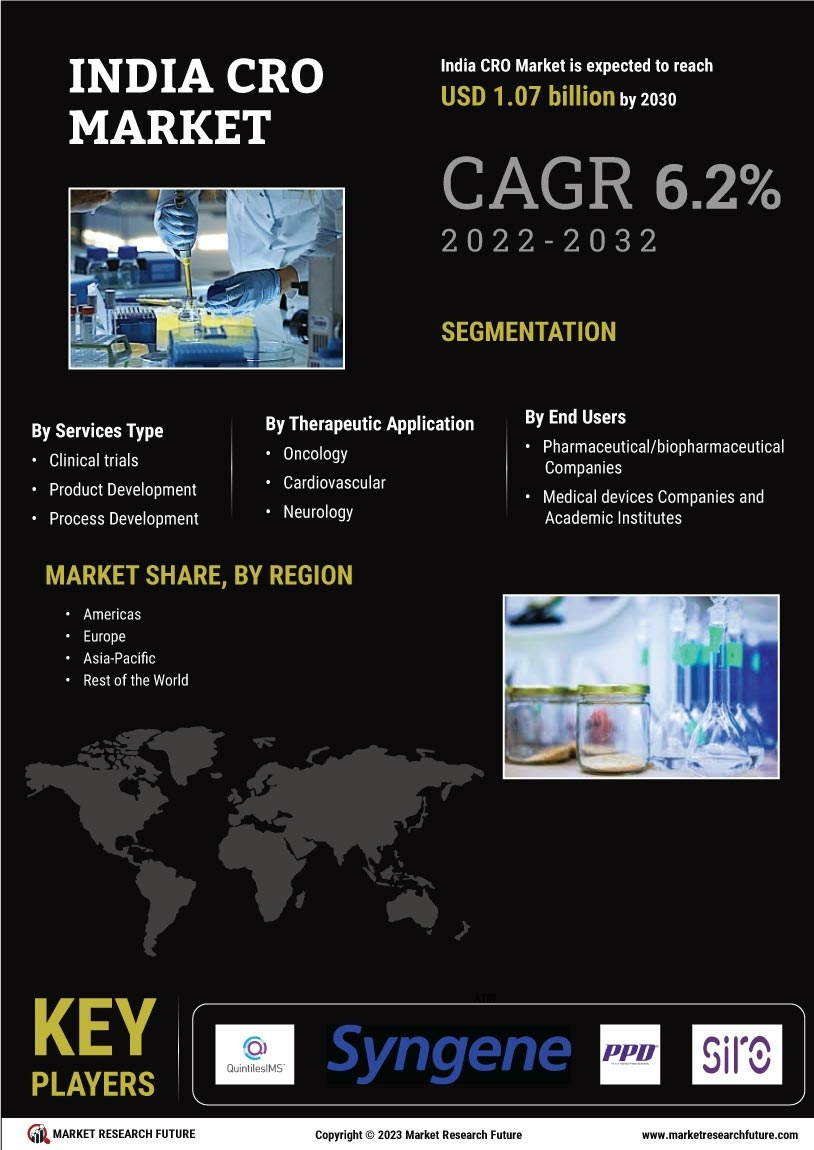

Growing Pharmaceutical Sector

The India Contract Research Organization Market is experiencing a notable surge, primarily driven by the expanding pharmaceutical sector. As of January 2026, India ranks among the top global players in pharmaceutical production, contributing approximately 3.6% to the global market. This growth is attributed to increasing investments in research and development, with the Indian pharmaceutical industry projected to reach USD 130 billion by 2030. Consequently, the demand for contract research organizations (CROs) is likely to rise, as pharmaceutical companies seek to outsource clinical trials and other research activities to enhance efficiency and reduce costs. The collaboration between CROs and pharmaceutical firms is expected to foster innovation and expedite drug development processes, thereby solidifying the position of the India Contract Research Organization Market in the global landscape.

Increased Focus on Clinical Trials

The India Contract Research Organization Market is witnessing a significant increase in the number of clinical trials being conducted within the country. As of January 2026, India has become an attractive destination for clinical research due to its diverse patient population and cost-effective services. The number of clinical trials registered in India has seen a steady rise, with over 1,000 trials reported in 2025 alone. This trend is further supported by the Indian government's initiatives to streamline regulatory processes and enhance the approval timelines for clinical trials. As a result, CROs are likely to play a pivotal role in facilitating these trials, providing essential services such as patient recruitment, data management, and regulatory compliance. The growing emphasis on clinical trials is expected to bolster the India Contract Research Organization Market, making it a key player in the global clinical research arena.

Rising Demand for Outsourcing Services

The India Contract Research Organization Market is experiencing a rising demand for outsourcing services among pharmaceutical and biotechnology companies. As of January 2026, many organizations are increasingly recognizing the benefits of outsourcing research activities to specialized CROs, which can provide expertise, reduce operational costs, and accelerate time-to-market for new products. The outsourcing market in India is projected to grow significantly, with an estimated CAGR of 12% over the next five years. This trend is driven by the need for companies to focus on core competencies while leveraging the capabilities of CROs for clinical trials, data analysis, and regulatory compliance. The growing inclination towards outsourcing is likely to solidify the role of the India Contract Research Organization Market as a key player in the global research landscape.

Emergence of Biotech and Genomic Research

The India Contract Research Organization Market is increasingly influenced by the emergence of biotechnology and genomic research. As of January 2026, India is witnessing a rapid growth in biotech startups and research initiatives, with the biotechnology sector projected to reach USD 100 billion by 2025. This growth is largely driven by advancements in genomics, personalized medicine, and biopharmaceuticals. CROs are becoming essential partners in this landscape, offering specialized services in areas such as bioanalytical testing, clinical trial management, and regulatory support. The collaboration between CROs and biotech firms is likely to enhance the development of innovative therapies and diagnostics, thereby positioning the India Contract Research Organization Market as a vital contributor to the global biotech ecosystem.

Government Support and Policy Initiatives

The India Contract Research Organization Market is benefiting from robust government support and favorable policy initiatives aimed at promoting research and development. As of January 2026, the Indian government has implemented various schemes to encourage investment in the life sciences sector, including tax incentives and funding for research projects. The establishment of the National Biotechnology Development Strategy has further strengthened the framework for biotech research and development. These initiatives are likely to enhance the operational environment for CROs, enabling them to expand their services and capabilities. The supportive regulatory landscape is expected to attract more international clients, thereby reinforcing the position of the India Contract Research Organization Market on the global stage.