North America : Leading Market Innovators

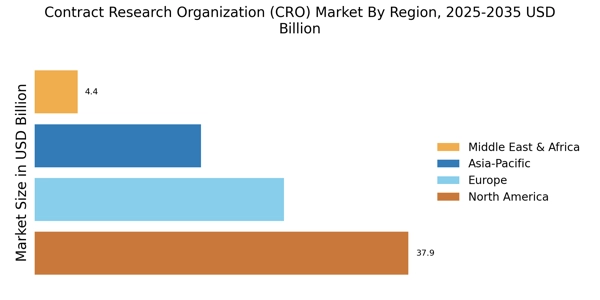

North America accounted for the largest share of the global Contract Research Organization Market size, reaching USD 37.9 billion in 2024. The region's growth is driven by a robust pharmaceutical industry, increasing R&D investments, and a favorable regulatory environment. The demand for clinical trials and outsourcing services is on the rise, fueled by advancements in technology and a focus on personalized medicine. Regulatory catalysts, such as streamlined approval processes, further enhance market dynamics.

The competitive landscape in North America is characterized by the presence of major players like IQVIA, Labcorp Drug Development, and PPD. These companies leverage their extensive networks and expertise to offer comprehensive services across various therapeutic areas. The U.S. remains the leading country, with a strong focus on innovation and a well-established infrastructure for clinical research. This competitive edge positions North America as a key player in The Contract Research Organization.

Europe : Emerging Regulatory Frameworks

Europe's CRO market is poised for growth, currently holding a 25.0% share. The region benefits from a diverse pharmaceutical landscape and increasing collaboration between academia and industry. Regulatory changes aimed at expediting drug approvals and enhancing patient safety are driving demand for CRO services. The emphasis on clinical trial transparency and data integrity is also shaping the market, encouraging investment in innovative research methodologies.

Leading countries in Europe include Germany, France, and the UK, which are home to several prominent CROs. The competitive landscape features key players such as Syneos Health and Charles River Laboratories, who are adapting to the evolving regulatory environment. The presence of a skilled workforce and advanced research facilities further strengthens Europe's position in The Contract Research Organization. As regulations evolve, companies are increasingly focusing on compliance and quality assurance to maintain their competitive edge.

Asia-Pacific : Rapid Growth Potential

The Asia-Pacific region is witnessing rapid growth in the CRO market, currently accounting for 10.0% of the global share. This growth is driven by increasing investments in healthcare infrastructure, a rising number of clinical trials, and a growing demand for cost-effective research solutions. Countries like China and India are emerging as key players, supported by favorable government policies and a large patient population, which enhance the region's attractiveness for clinical research.

The competitive landscape in Asia-Pacific is evolving, with both local and international CROs expanding their presence. Companies such as Wuxi AppTec are capitalizing on the region's growth potential by offering a wide range of services tailored to meet local needs. The increasing focus on biopharmaceuticals and personalized medicine is further driving demand for CRO services, positioning Asia-Pacific as a significant player in the global market.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa (MEA) region represents an untapped market in the CRO sector, currently holding a 4.3% share. The growth in this region is fueled by increasing healthcare investments, a rising prevalence of chronic diseases, and a growing interest in clinical research. Governments are actively promoting initiatives to enhance healthcare infrastructure, which is expected to drive demand for CRO services in the coming years. Countries like South Africa and the UAE are leading the way in establishing a robust clinical research environment.

The competitive landscape is gradually evolving, with both local and international CROs recognizing the potential of the MEA market. As the region continues to develop, the presence of key players and investment in research capabilities will be crucial for capturing market opportunities and driving growth.