Growing Adoption in Healthcare

The healthcare sector is increasingly adopting 3D display technologies, which serves as a significant driver for the India 3D display market. Medical professionals are utilizing 3D displays for various applications, including surgical planning, medical imaging, and patient education. The ability to visualize complex anatomical structures in three dimensions enhances the accuracy of diagnoses and improves surgical outcomes. As of January 2026, it is estimated that the healthcare segment accounts for approximately 20% of the total market share in the India 3D display market. This trend is likely to continue as healthcare providers recognize the benefits of 3D visualization in improving patient care. The integration of 3D displays in healthcare is thus contributing to the overall growth and diversification of the India 3D display market.

Integration of 3D Displays in Retail

The integration of 3D displays in the retail sector is emerging as a pivotal driver for the India 3D display market. Retailers are increasingly adopting 3D display technologies to enhance customer engagement and improve the shopping experience. By utilizing 3D displays, brands can showcase products in a more dynamic and visually appealing manner, which can lead to higher conversion rates. As of January 2026, it is estimated that around 30% of major retail outlets in urban areas have incorporated 3D displays into their marketing strategies. This trend is likely to continue as retailers recognize the potential of 3D technology to differentiate themselves in a competitive market. The India 3D display market is thus benefiting from this retail transformation, as businesses seek innovative ways to attract and retain customers.

Advancements in 3D Display Technology

Technological advancements are significantly influencing the India 3D display market. Innovations in display technologies, such as OLED and holographic displays, are enhancing the quality and accessibility of 3D content. These advancements are not only improving visual fidelity but also reducing production costs, making 3D displays more viable for various applications. As of January 2026, the market for 3D displays is expected to reach a valuation of USD 1 billion, driven by these technological improvements. Additionally, the rise of augmented reality (AR) and virtual reality (VR) applications is further propelling the demand for high-quality 3D displays. The India 3D display market is thus positioned to capitalize on these technological trends, which are likely to redefine how consumers interact with digital content.

Rising Demand for Enhanced Visual Experiences

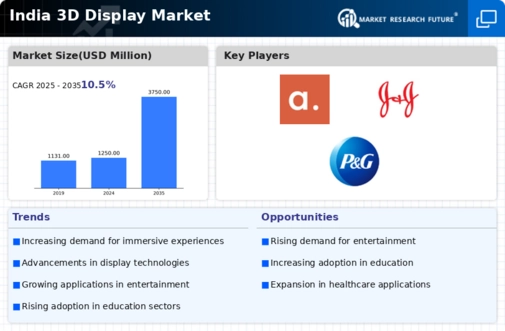

The India 3D display market is witnessing a notable surge in demand for enhanced visual experiences across various sectors. This trend is primarily driven by the increasing consumer preference for immersive content in entertainment, gaming, and advertising. As of January 2026, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 15% over the next five years. This growth is indicative of a broader shift towards high-definition and three-dimensional content, which is becoming increasingly accessible due to advancements in display technologies. Furthermore, the proliferation of 3D-enabled devices, such as televisions and smartphones, is likely to contribute to this demand, as consumers seek more engaging and interactive experiences. The India 3D display market appears poised for substantial expansion as it aligns with evolving consumer expectations.

Increased Investment in Entertainment and Media

Investment in the entertainment and media sector is driving the growth of the India 3D display market. With the rise of 3D movies, gaming, and virtual reality experiences, there is a growing need for high-quality 3D displays that can deliver immersive content. As of January 2026, the Indian film industry has seen a significant increase in the production of 3D films, with over 50 new titles released in the past year alone. This trend is likely to continue as filmmakers and game developers seek to leverage 3D technology to enhance storytelling and audience engagement. The India 3D display market is thus benefiting from this influx of investment, which is expected to further stimulate demand for advanced display technologies.