Mobile Internet Penetration

The rapid increase in mobile internet penetration in India is reshaping the programmatic display-advertising market. With over 700 million smartphone users, the mobile-first approach is becoming essential for advertisers. The accessibility of mobile devices allows for real-time engagement with consumers, making programmatic advertising more effective. Advertisers are increasingly focusing on mobile-optimized campaigns to capture the attention of users on the go. This shift is reflected in the growing share of mobile advertising, which is expected to account for over 50% of total digital ad spend in the coming years. Consequently, the programmatic display-advertising market is likely to adapt to this mobile-centric landscape, offering innovative solutions tailored for mobile users.

Advancements in Data Analytics

The programmatic display-advertising market is significantly influenced by advancements in data analytics technologies. With the ability to collect and analyze vast amounts of consumer data, advertisers can create highly targeted campaigns that resonate with specific audiences. In India, the integration of machine learning and artificial intelligence into data analytics tools is enhancing the effectiveness of programmatic advertising. This allows for better audience segmentation and personalized ad experiences. As a result, advertisers are likely to see improved engagement rates and conversion metrics. The market is expected to witness a surge in demand for analytics-driven programmatic solutions, as businesses aim to leverage data insights to refine their advertising strategies and achieve better outcomes.

Growth of E-commerce Platforms

The expansion of e-commerce platforms in India is a significant driver for the programmatic display-advertising market. As online shopping continues to gain traction, e-commerce companies are increasingly investing in programmatic advertising to reach potential customers effectively. The Indian e-commerce market is projected to grow to $200 billion by 2026, creating a fertile ground for programmatic strategies. These platforms utilize programmatic advertising to target users based on their browsing behavior and preferences, thereby enhancing the likelihood of conversions. This trend suggests that as e-commerce continues to flourish, the demand for programmatic display advertising will likely increase, providing advertisers with opportunities to engage with consumers at various touchpoints throughout their shopping journey.

Rising Digital Advertising Spend

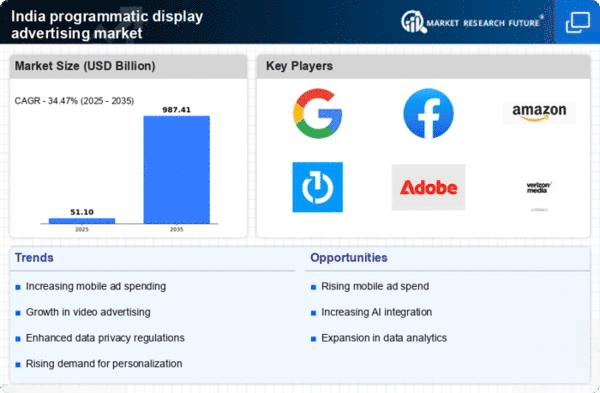

The programmatic display-advertising market in India is experiencing a notable increase in digital advertising expenditure. As businesses recognize the importance of online presence, the overall digital ad spend is projected to reach approximately $10 billion by 2025. This growth is driven by the shift from traditional advertising to digital platforms, where programmatic advertising offers efficiency and targeted reach. Companies are allocating larger portions of their marketing budgets to programmatic strategies, which allow for real-time bidding and data-driven decision-making. This trend indicates a robust demand for programmatic solutions, as advertisers seek to optimize their campaigns and maximize return on investment. The increasing competition among brands further fuels this trend, as they strive to capture consumer attention in a crowded digital landscape.

Regulatory Developments in Advertising

The evolving regulatory landscape in India is influencing the programmatic display-advertising market. As the government implements stricter guidelines on digital advertising practices, businesses must adapt their strategies to ensure compliance. This includes adhering to data privacy regulations and transparency in advertising practices. The introduction of regulations may initially pose challenges for advertisers, but it also presents opportunities for those who can navigate the complexities effectively. Companies that prioritize compliance are likely to gain consumer trust, which is essential in a competitive market. As the regulatory environment continues to develop, the programmatic display-advertising market may see a shift towards more ethical advertising practices, ultimately benefiting both advertisers and consumers.