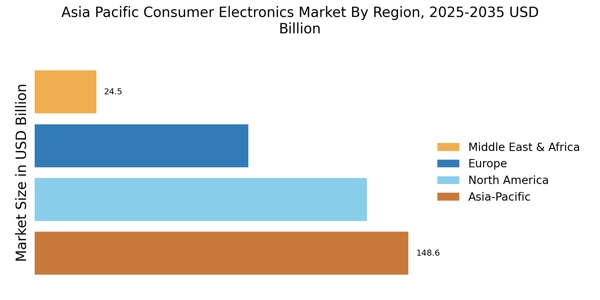

China : Unmatched Market Share and Growth

China holds a staggering 180.0 in market value, representing 45% of the APAC consumer electronics market. Key growth drivers include rapid urbanization, increasing disposable incomes, and a tech-savvy population. The demand for smart devices, particularly smartphones and home appliances, is surging. Government initiatives promoting innovation and digital infrastructure development further bolster this growth, creating a conducive environment for industry expansion.

India : Rapid Growth in Consumer Demand

India's consumer electronics market is valued at 90.0, accounting for 22.5% of the APAC market. The growth is fueled by rising middle-class incomes, urbanization, and increasing internet penetration. Government initiatives like 'Make in India' are encouraging local manufacturing, while regulatory policies are improving ease of doing business. The demand for affordable smartphones and smart home devices is particularly strong, reflecting changing consumer preferences.

Japan : Quality and Precision in Electronics

Japan's market value stands at 70.0, representing 17.5% of the APAC consumer electronics market. The country is known for its technological innovation and high-quality products. Key growth drivers include a strong focus on R&D and a mature consumer base that values premium electronics. Government policies supporting technology development and sustainability initiatives are also significant. The demand for advanced robotics and smart home technologies is on the rise.

South Korea : Home of Global Electronics Giants

South Korea's consumer electronics market is valued at 50.0, making up 12.5% of the APAC market. The country is home to major players like Samsung and LG, driving innovation in smart devices and home appliances. Key growth drivers include high internet penetration and a tech-savvy population. Government support for R&D and digital infrastructure enhances market conditions. Cities like Seoul and Busan are key markets, showcasing a competitive landscape with a focus on premium products.

Malaysia : Diverse Consumer Preferences Emerge

Malaysia's consumer electronics market is valued at 20.0, accounting for 5% of the APAC market. The growth is driven by increasing urbanization and a young population eager for technology. Government initiatives promoting digital economy and local manufacturing are pivotal. The demand for smartphones and wearables is rising, reflecting changing consumer habits. Key markets include Kuala Lumpur and Penang, where competition is intensifying among local and international brands.

Thailand : Cultural Trends Shape Consumption

Thailand's consumer electronics market is valued at 15.0, representing 3.75% of the APAC market. The growth is supported by a young, tech-savvy population and increasing disposable incomes. Government policies promoting digital transformation and e-commerce are significant. The demand for mobile devices and smart home products is growing. Bangkok and Chiang Mai are key markets, with a competitive landscape featuring both local and international players.

Indonesia : Youthful Demographics Drive Demand

Indonesia's consumer electronics market is valued at 10.0, making up 2.5% of the APAC market. The growth is driven by a large youth population and increasing internet access. Government initiatives to enhance digital infrastructure and local manufacturing are crucial. The demand for smartphones and affordable electronics is on the rise. Jakarta and Surabaya are key markets, with a competitive environment featuring both local and global brands.

Rest of APAC : Varied Growth Across Sub-regions

The Rest of APAC market is valued at 5.0, accounting for 1.25% of the overall consumer electronics market. Growth varies significantly across countries, driven by local consumer preferences and economic conditions. Government policies supporting technology adoption and infrastructure development play a role. Demand for basic electronics and mobile devices is prevalent. Key markets include emerging economies where competition is growing among local and international brands.