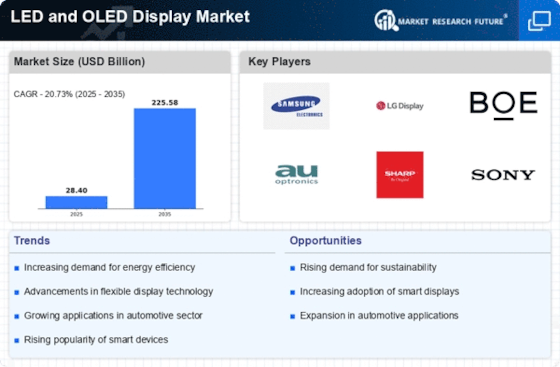

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the LED and OLED Display market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, LED and OLED Display Industry must offer cost-effective items.Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global LED and OLED Display Industry to benefit clients and increase the market sector. In recent years, the LED and OLED Display Industry has offered some of the most significant advantages to medicine. Major players in the LED and OLED Display market, including Samsung Display Co. Ltd, LG Display Co. Ltd, Sony Corporation, Raystar Optronics Inc., Pioneer Corporation Nokia, Panasonic Corporation, Mouser Electronics, 4D Systems, Raystar, and Digilent, are attempting to increase market demand by investing in research and development operations.Formerly known as CenturyLink Inc., Lumen Technologies Inc. (Lumen Technologies) is a provider of managed services, cloud computing, network services, and communications. Local and long-distance, broadband, private line, managed hosting, data integration, ethernet, network access, video, wireless, voice, and other services are provided by the company. Additionally, it offers expert services and other support services. Federal, state, local, and business clients are all served. Through inbound call centres, direct sales reps, telemarketing, and third parties, such as merchants, door-to-door salespeople, satellite television providers, and digital marketing companies, the corporation offers its products.Africa, the Middle East, Asia-Pacific, and North America are all regions in which the organisation conducts business. Monroe, Louisiana, in the US, is home to Lumen Technologies' main office. OLEDWorks and Lumenique LLC formed a partnership in November 2020. Lumenique, a manufacturer of illuminated art, rises to the top in the development of OLED lighting as a result of this relationship. The company will offer amazing portable illumination thanks to the newest OLED lighting panels.Consumer electronics, information technology, mobile communications, and device solutions are all produced by Samsung Electronics Co. Ltd. (Samsung), a division of the Samsung Group. Televisions (TV), refrigerators, washing machines, air conditioners, medical equipment, printers, monitors, computers, network systems, and digital cameras are among the company's product offerings.

In August Samsung Electronics announced that it had scaled back LCD production in preparation for a significant investment in quantum dot OLED panels, also known as (QD) OLED displays, which combine OLED and quantum dot technology.