Growing Adoption in Retail Sector

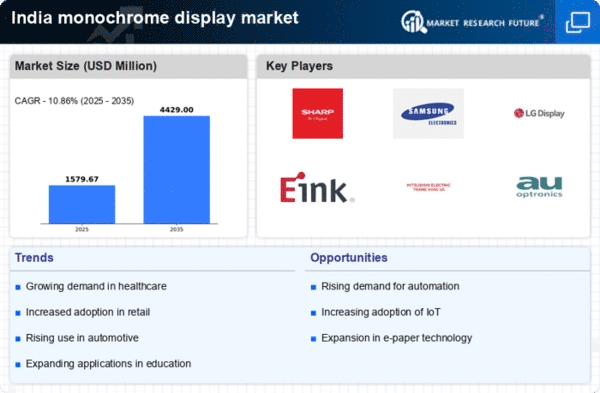

The retail sector in India is increasingly adopting monochrome display technology for various applications, including point-of-sale systems and inventory management. This trend is driven by the need for cost-effective solutions that provide clear visibility in various lighting conditions. Monochrome displays are particularly favored for their simplicity and reliability, which are essential in high-traffic retail environments. The monochrome display market is projected to grow as retailers seek to enhance operational efficiency and customer experience. With an estimated growth rate of 8% annually, the retail sector's demand for monochrome displays is expected to significantly contribute to the overall market expansion.

Technological Integration with IoT

The integration of monochrome displays with Internet of Things (IoT) devices is emerging as a significant driver in the Indian market. As industries adopt IoT solutions for enhanced connectivity and data management, the need for reliable display interfaces becomes crucial. Monochrome displays are often utilized in IoT applications due to their simplicity and effectiveness in conveying information. This trend is expected to propel the monochrome display market forward, as businesses leverage IoT technologies to improve operational efficiency and data visualization.

Increased Focus on Energy Efficiency

Energy efficiency is becoming a critical consideration for businesses in India, influencing their choice of display technologies. Monochrome displays consume significantly less power compared to their color counterparts, aligning with the growing emphasis on sustainability and reducing operational costs. This trend is particularly relevant in sectors such as transportation and telecommunications, where energy consumption directly impacts profitability. The monochrome display market is likely to benefit from this shift, as organizations seek to minimize their carbon footprint while maintaining effective communication and information dissemination.

Rising Demand in Healthcare Applications

The healthcare sector in India is witnessing a rising demand for monochrome displays, particularly in medical imaging and diagnostic equipment. These displays offer high contrast and clarity, which are essential for accurate interpretation of medical data. As hospitals and clinics increasingly invest in advanced medical technologies, the monochrome display market is projected to grow substantially. The integration of monochrome displays in devices such as ultrasound machines and patient monitoring systems is likely to enhance diagnostic capabilities, thereby driving market expansion in the healthcare domain.

Cost-Effectiveness of Monochrome Displays

Monochrome displays are recognized for their cost-effectiveness, making them an attractive option for various industries in India. The lower production costs associated with monochrome technology allow businesses to implement these displays without substantial financial investment. This affordability is particularly appealing to small and medium enterprises (SMEs) that require reliable display solutions without incurring high expenses. As the monochrome display market continues to evolve, the emphasis on budget-friendly options is likely to drive further adoption across sectors such as healthcare, manufacturing, and logistics, where cost efficiency is paramount.