Rising Passenger Expectations

In the In-flight Internet Market, rising passenger expectations play a crucial role in shaping service offerings. Modern travelers increasingly demand seamless connectivity during flights, driven by their reliance on digital devices for work and leisure. Surveys indicate that over 70% of passengers consider in-flight internet access a necessity rather than a luxury. This shift in consumer behavior compels airlines to prioritize the implementation of reliable internet services. Furthermore, airlines that fail to meet these expectations risk losing customers to competitors who offer superior connectivity options. As a result, the In-flight Internet Market is likely to see airlines investing more in enhancing their internet services to cater to the evolving needs of passengers.

Regulatory Support and Compliance

Regulatory support and compliance are pivotal drivers in the In-flight Internet Market, influencing how airlines implement and manage in-flight connectivity services. Governments and aviation authorities are increasingly recognizing the importance of in-flight internet access, leading to the establishment of regulations that facilitate its deployment. For instance, some regions have relaxed restrictions on the use of personal electronic devices during flights, thereby promoting the use of in-flight internet services. Additionally, compliance with data protection and cybersecurity regulations is becoming essential as airlines collect and manage passenger data. This regulatory framework not only ensures passenger safety but also fosters trust in in-flight internet services. As a result, the In-flight Internet Market is likely to benefit from a more structured environment that encourages investment and innovation.

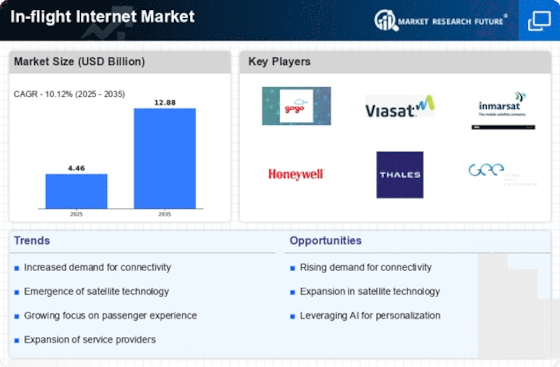

Competitive Landscape and Market Dynamics

The competitive landscape within the In-flight Internet Market is intensifying as airlines and service providers strive to capture market share. With numerous players entering the market, including traditional telecom companies and new entrants specializing in aviation connectivity, the competition is becoming increasingly fierce. This dynamic environment encourages innovation and the development of unique service offerings. Market data suggests that the in-flight internet services market is expected to grow at a compound annual growth rate (CAGR) of approximately 12% over the next five years. This growth is driven by the need for airlines to enhance passenger satisfaction and differentiate themselves in a crowded marketplace. Consequently, the In-flight Internet Market is likely to witness strategic partnerships and collaborations aimed at improving service delivery and expanding coverage.

Technological Innovations in Connectivity

The In-flight Internet Market is experiencing a surge in technological innovations that enhance connectivity options for passengers. Advancements in satellite technology, such as high-throughput satellites (HTS), are enabling airlines to provide faster and more reliable internet services. The introduction of 5G technology is also anticipated to revolutionize in-flight connectivity, offering higher bandwidth and lower latency. According to recent data, the number of aircraft equipped with in-flight internet is projected to reach over 20,000 by 2025, indicating a robust growth trajectory. These technological advancements not only improve the passenger experience but also allow airlines to differentiate their services in a competitive market. As a result, the In-flight Internet Market is likely to witness increased investment infrastructure and partnerships with technology providers.

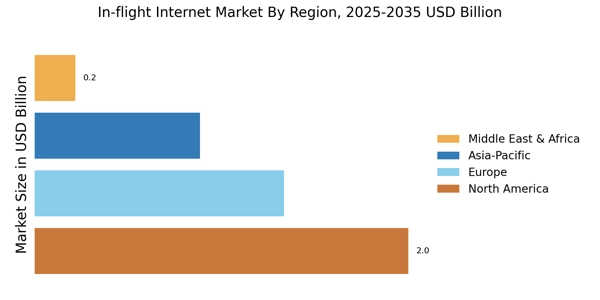

Emerging Markets and Expansion Opportunities

Emerging markets present substantial expansion opportunities for the In-flight Internet Market, as airlines seek to tap into new customer bases. Regions with growing air travel demand, such as Asia-Pacific and Latin America, are witnessing an increase in the number of airlines offering in-flight internet services. Market analysis indicates that the Asia-Pacific region alone is expected to account for a significant share of the in-flight internet market by 2025, driven by rising disposable incomes and a burgeoning middle class. Airlines operating in these regions are likely to invest in upgrading their fleets to include connectivity options, thereby enhancing their competitive edge. This trend suggests that the In-flight Internet Market will continue to evolve, with airlines focusing on meeting the connectivity needs of passengers in emerging markets.