Hydrogen Generation Size

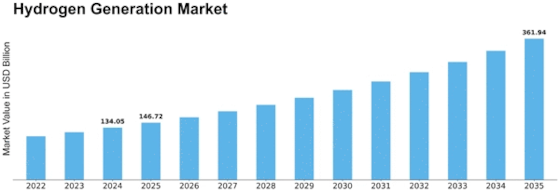

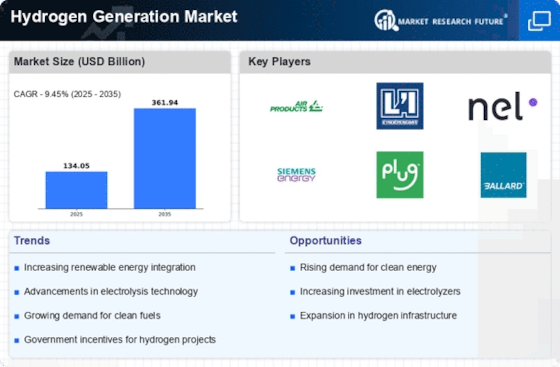

Hydrogen Generation Market Growth Projections and Opportunities

The market for hydrogen generation is significantly influenced by a large number of market factors that considerably decide its elements. A significant variable driving the market is the rising global accentuation on moving towards feasible and harmless to the ecosystem energy sources. Given its true capacity as an inexhaustible fuel and the endeavours of countries to lessen their carbon impression and stop environmental change, hydrogen arises as a great arrangement. Furthermore, unofficial laws and strategies essentially affect the hydrogen generation market. Most of countries are carrying out strategies to empower the utilization of hydrogen as a substitute energy source. Market extension is worked with by endowments, monetary motivations, and administrative systems that empower the organization and improvement of hydrogen advances. The expense of hydrogen creation is a critical determinant that influences the market. The consistent movement of innovation in hydrogen creation towards more noteworthy expense adequacy adds to the improvement of hydrogen's monetary achievability. The expense part is a basic determinant in surveying the overall seriousness of hydrogen in contrast with customary petroleum products. Also, the hydrogen generation market is moved by the rising interest for energy capacity arrangements and the overall energy interest. Hydrogen shows uncommon capacities as both an energy transporter and capacity medium, really relieving the irregular qualities of sustainable power sources, for example, sunlight based and wind. As the quantity of sustainable power establishments increments, so does the interest in hydrogen as a stockpiling answer for empower the release of overabundance energy during times of popularity. Innovative work tries and mechanical headways affect the hydrogen age market. Movements in electrolysis, an urgent strategy utilized in the age of hydrogen, expand functional viability and reduce consumptions. Moreover, market factors are influenced by the growing utilization of hydrogen across businesses. Hydrogen is used in various enterprises, including transportation, mixtures, and assembling. As a harmless to the ecosystem substitute for regular gas-powered motors, hydrogen energy unit vehicles are drawing in expanded consideration in the transportation area. Organizations and worldwide coordinated efforts impact the market for hydrogen generation. Joint endeavours and coordinated efforts are being laid out among countries and organizations to exploit their particular abilities in foundation arrangement, innovation headway, and market passage. These cooperative endeavours work with the overall execution of hydrogen and lay out a market environment that is more interconnected and heartier. Mechanical progressions, global joint efforts, natural worries, and government arrangements are all market factors that by and large impact the direction of the hydrogen generation market. With the worldwide local area advancing towards an all the more harmless to the ecosystem and carbon-unbiased future, the market for hydrogen age is situated to be a basic part in fulfilling the rising requirement for sustainable and unadulterated energy.

Leave a Comment