Rising Energy Demand

The increasing energy demand across various sectors appears to be a primary driver for the Captive Hydrogen Generation Market. As industries seek to meet their energy needs sustainably, hydrogen emerges as a viable alternative. The International Energy Agency indicates that hydrogen could account for up to 18% of total energy demand by 2050. This shift is likely to encourage companies to invest in captive hydrogen generation systems, which can provide a reliable and on-site energy source. Furthermore, the need for energy security and independence is prompting businesses to explore hydrogen as a means to reduce reliance on traditional fossil fuels. Consequently, the Captive Hydrogen Generation Market is poised for growth as organizations prioritize energy efficiency and sustainability.

Technological Innovations

Technological innovations are playing a crucial role in shaping the Captive Hydrogen Generation Market. The development of advanced hydrogen production methods, such as high-temperature electrolysis and biomass gasification, is enhancing the efficiency and sustainability of hydrogen generation. These innovations are likely to lower production costs and improve the overall viability of captive hydrogen systems. Furthermore, the integration of digital technologies, such as artificial intelligence and IoT, is enabling better monitoring and optimization of hydrogen production processes. As these technologies continue to evolve, they may attract more industries to adopt captive hydrogen generation solutions. The Captive Hydrogen Generation Market is thus positioned for growth as technological advancements pave the way for more efficient and sustainable hydrogen production.

Decarbonization Initiatives

Decarbonization initiatives are increasingly influencing the Captive Hydrogen Generation Market. Governments and organizations are setting ambitious targets to reduce carbon emissions, which is driving the demand for cleaner energy sources. Hydrogen, particularly green hydrogen produced from renewable energy, is seen as a key player in achieving these targets. The European Union has set a goal to become climate-neutral by 2050, which includes significant investments in hydrogen infrastructure. This regulatory push is likely to encourage industries to adopt captive hydrogen generation systems as part of their decarbonization strategies. Furthermore, the Captive Hydrogen Generation Market may benefit from partnerships between governments and private sectors aimed at developing hydrogen technologies and infrastructure, thereby accelerating market growth.

Cost Reduction in Hydrogen Production

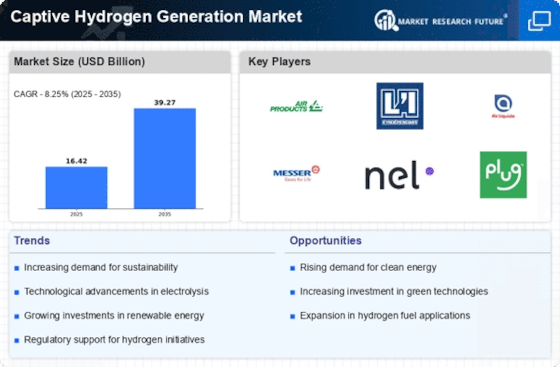

The Captive Hydrogen Generation Market is experiencing a notable trend towards cost reduction in hydrogen production technologies. Advances in electrolysis and steam methane reforming have led to decreased operational costs, making hydrogen generation more economically viable. According to recent data, the cost of producing hydrogen through electrolysis has dropped by approximately 50% over the past decade. This reduction in costs is likely to attract more industries to adopt captive hydrogen generation systems, as they seek to lower their energy expenses while maintaining sustainability goals. Additionally, the decreasing costs of renewable energy sources, such as solar and wind, further enhance the feasibility of hydrogen production. As a result, the Captive Hydrogen Generation Market is expected to expand as businesses capitalize on these economic advantages.

Industrial Applications and Versatility

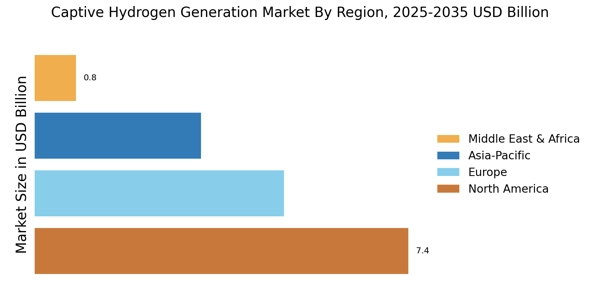

The versatility of hydrogen in various industrial applications is a significant driver for the Captive Hydrogen Generation Market. Hydrogen is utilized in sectors such as refining, ammonia production, and metal processing, where it serves as a critical feedstock. The demand for hydrogen in these applications is projected to grow, with estimates suggesting that the industrial hydrogen market could reach USD 200 billion by 2025. This increasing demand is likely to prompt industries to invest in captive hydrogen generation systems to ensure a consistent and reliable supply. Moreover, the ability to produce hydrogen on-site allows companies to enhance operational efficiency and reduce transportation costs. Consequently, the Captive Hydrogen Generation Market is expected to thrive as industries recognize the benefits of hydrogen in their processes.