Government Incentives and Policies

The Hydrogen Fueling Station Market is significantly influenced by government incentives and policies aimed at promoting hydrogen as a clean energy source. Various countries have implemented supportive frameworks, including subsidies, tax breaks, and grants, to encourage the development of hydrogen infrastructure. For instance, initiatives such as the Hydrogen Roadmap in several regions outline strategic plans for expanding hydrogen production and distribution networks. These policies not only facilitate investment in hydrogen fueling stations but also enhance public awareness and acceptance of hydrogen technologies. As a result, the market is expected to witness accelerated growth, with projections indicating that the number of hydrogen fueling stations could increase by over 50% in the next five years, reflecting the positive impact of these governmental efforts.

Growing Investment from Private Sector

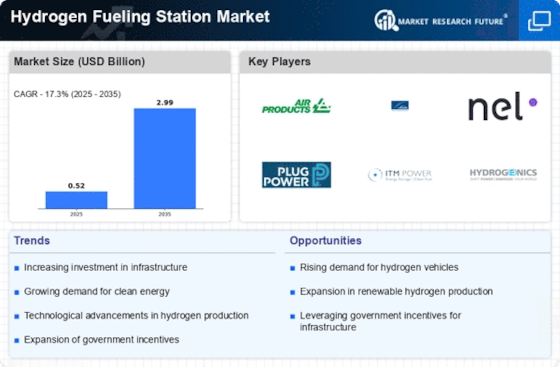

The Hydrogen Fueling Station Market is witnessing a notable increase in investment from the private sector, which is crucial for the expansion of hydrogen infrastructure. Major corporations, particularly in the energy and automotive sectors, are recognizing the potential of hydrogen as a clean fuel alternative and are committing substantial resources to develop fueling stations. Reports indicate that private investments in hydrogen technologies have surged, with billions allocated to research, development, and infrastructure projects. This influx of capital not only accelerates the deployment of hydrogen fueling stations but also fosters innovation within the industry. As private entities collaborate with governments and research institutions, the Hydrogen Fueling Station Market is poised for rapid growth, potentially doubling the number of operational stations within the next decade.

Increasing Demand for Clean Energy Solutions

The Hydrogen Fueling Station Market is experiencing a surge in demand for clean energy solutions, driven by the global shift towards sustainable energy sources. Governments and organizations are increasingly prioritizing the reduction of greenhouse gas emissions, which has led to a growing interest in hydrogen as a viable alternative to fossil fuels. According to recent data, the hydrogen market is projected to reach a value of over 200 billion by 2030, indicating a robust growth trajectory. This demand is further fueled by the automotive sector's transition to hydrogen fuel cell vehicles, which are seen as a key component in achieving carbon neutrality. As more consumers and businesses seek environmentally friendly options, the Hydrogen Fueling Station Market is likely to expand significantly to meet this rising demand.

Rising Adoption of Hydrogen Fuel Cell Vehicles

The increasing adoption of hydrogen fuel cell vehicles (FCVs) is a significant driver for the Hydrogen Fueling Station Market. As consumers and manufacturers alike recognize the benefits of FCVs, including longer ranges and shorter refueling times compared to battery electric vehicles, the demand for hydrogen fueling stations is expected to rise correspondingly. Data indicates that the sales of hydrogen FCVs are projected to reach over 1 million units by 2030, necessitating a robust network of fueling stations to support this growth. Furthermore, partnerships between automotive manufacturers and hydrogen infrastructure providers are becoming more common, facilitating the establishment of new fueling stations. This trend not only enhances the accessibility of hydrogen as a fuel source but also solidifies the Hydrogen Fueling Station Market's role in the broader transition to sustainable transportation.

Technological Innovations in Hydrogen Production

Technological advancements in hydrogen production are playing a pivotal role in shaping the Hydrogen Fueling Station Market. Innovations such as electrolysis, which utilizes renewable energy sources to produce hydrogen, are becoming more efficient and cost-effective. Recent studies suggest that the cost of green hydrogen production could decrease by up to 30% by 2030, making it a more attractive option for fueling stations. Additionally, improvements in storage and distribution technologies are enhancing the feasibility of hydrogen as a mainstream fuel. These advancements not only support the establishment of new hydrogen fueling stations but also contribute to the overall sustainability of the hydrogen supply chain. As technology continues to evolve, the Hydrogen Fueling Station Market is likely to benefit from increased efficiency and reduced operational costs.