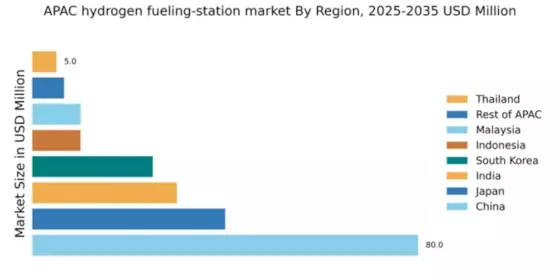

China : Unmatched Growth and Infrastructure

China holds a staggering 80.0% market share in the APAC hydrogen fueling-station market, driven by aggressive government policies promoting clean energy and substantial investments in infrastructure. The demand for hydrogen is surging, particularly in urban areas, as cities like Beijing and Shanghai implement initiatives to reduce carbon emissions. The government’s commitment to hydrogen as a key energy source is evident in its 14th Five-Year Plan, which emphasizes the development of hydrogen production and distribution networks.

India : Government Support Fuels Growth

India's hydrogen fueling-station market is projected to capture 30.0% of the APAC share, driven by government initiatives like the National Hydrogen Mission. The increasing focus on renewable energy and the automotive sector's shift towards hydrogen fuel cell vehicles are key growth drivers. Cities such as Delhi and Mumbai are leading the charge, with policies aimed at enhancing infrastructure and reducing emissions, creating a favorable environment for hydrogen adoption.

Japan : Pioneering Fuel Cell Advancements

Japan commands a 40.0% market share in the hydrogen fueling-station sector, bolstered by its advanced technology and strong government backing. The country is a leader in fuel cell technology, with significant investments in R&D. Regulatory frameworks support hydrogen infrastructure development, particularly in regions like Tokyo and Fukuoka, where the government promotes hydrogen as a clean energy source to meet its carbon neutrality goals by 2050.

South Korea : Government-Driven Market Expansion

South Korea holds a 25.0% share in the hydrogen fueling-station market, supported by the government’s Hydrogen Economy Roadmap. This initiative aims to establish a comprehensive hydrogen ecosystem, with cities like Ulsan and Seoul at the forefront. The demand for hydrogen is rising, particularly in the transportation sector, as the government incentivizes fuel cell vehicles and infrastructure development, creating a robust market environment.

Malaysia : Investment in Clean Energy Solutions

Malaysia's hydrogen fueling-station market accounts for 10.0% of the APAC share, with growing interest in hydrogen as a clean energy alternative. The government is exploring partnerships to enhance infrastructure, particularly in urban centers like Kuala Lumpur. Demand is driven by the automotive sector's shift towards sustainable solutions, supported by regulatory frameworks that encourage investment in hydrogen technologies and infrastructure development.

Thailand : Emerging Opportunities in Energy

Thailand captures 5.0% of the hydrogen fueling-station market, with increasing government focus on renewable energy. The Energy Policy and Planning Office is promoting hydrogen as a viable energy source, particularly in cities like Bangkok. The competitive landscape is evolving, with local and international players investing in infrastructure to meet the growing demand for hydrogen fuel cell vehicles, creating a dynamic market environment.

Indonesia : Investments in Renewable Energy

Indonesia's hydrogen fueling-station market represents 10.0% of the APAC share, with significant potential for growth driven by government initiatives aimed at promoting renewable energy. Key cities like Jakarta are exploring hydrogen as a clean alternative to fossil fuels. The competitive landscape is gradually developing, with both local and international companies looking to establish a presence in the market, supported by favorable regulatory policies.

Rest of APAC : Regional Variations in Market Dynamics

The Rest of APAC accounts for 6.6% of the hydrogen fueling-station market, showcasing diverse opportunities across various countries. Each nation has unique regulatory frameworks and market conditions influencing hydrogen adoption. Countries like Vietnam and the Philippines are beginning to explore hydrogen as a clean energy source, driven by local demand and government initiatives aimed at reducing carbon emissions and enhancing energy security.