Top Industry Leaders in the Hydrogen Fueling Station Market

*Disclaimer: List of key companies in no particular order

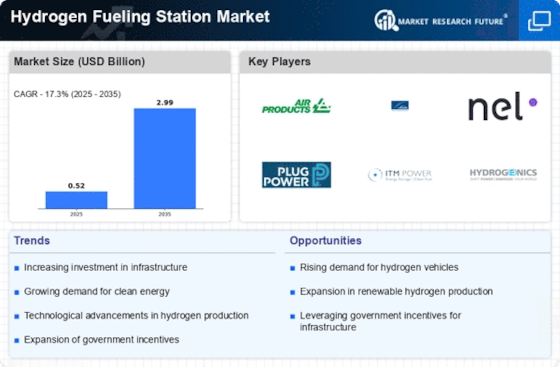

The hydrogen fueling station market, although in its infancy, holds significant promise for future expansion. With the global emphasis on cleaner energy sources gaining momentum, hydrogen fuel cell vehicles (FCEVs) are witnessing increased popularity, consequently driving the demand for hydrogen fueling infrastructure. This surge in demand has led to a diverse array of participants entering the market, shaping a dynamic and competitive landscape.

Key Players:

The current state of the hydrogen fueling station market is characterized by a mix of established energy conglomerates, technology entities, and new entrants specializing in hydrogen infrastructure development. Notable players include:

-

Oil & Gas Companies: Shell, TotalEnergies, BP, Chevron, ExxonMobil -

Industrial Gas Companies: Air Liquide, Linde, Praxair, Messer -

Automobile Manufacturers: Toyota, Hyundai, Honda, BMW, Daimler -

Hydrogen Infrastructure Players: Plug Power, Nel Hydrogen, ITM Power, Hydrogenics, Nikola Corporation -

Utilities: Iwatani Corporation, Tokyo Gas, Osaka Gas

Competitive Strategies:

In this dynamic market, key players are employing various strategies to gain a competitive edge, including:

Partnerships and Collaborations: Forming strategic alliances with entities across the hydrogen value chain, such as automakers, gas providers, and technology developers, to harness collective expertise and resources.

Technological Innovation: Investing in research and development to enhance hydrogen fueling station technology, with a focus on improving efficiency, reducing costs, and enhancing safety.

Geographic Expansion: Expanding operations into new markets with substantial growth potential for FCEVs and hydrogen infrastructure.

Business Model Innovation: Exploring innovative business models, such as subscription-based fueling plans, to attract customers and mitigate upfront costs.

Government Incentives: Advocating for government policies and incentives supportive of the development and adoption of hydrogen FCEVs and fueling stations.

Factors for Market Share Analysis:

Several factors play a role in determining a player's market share in the hydrogen fueling station market, including:

Number of Stations: The quantity of operational hydrogen fueling stations managed by a company.

Geographical Presence: The regions in which a company operates its stations, with a focus on areas exhibiting high potential for FCEV adoption.

Technology Portfolio: The types of hydrogen fueling technologies offered, with an emphasis on advanced and efficient systems.

Customer Base: The diversity of customers served, encompassing individual consumers, fleet operators, and public transport authorities.

Brand Recognition: The reputation and brand recognition of the company within the hydrogen industry.

New and Emerging Companies:

The hydrogen fueling station market is witnessing the emergence of innovative startups concentrating on developing next-generation technologies for hydrogen production, storage, and dispensing. These companies aim to offer more efficient and cost-effective solutions. Examples include:

Hyzon Motors: A U.S.-based company specializing in the development and manufacturing of hydrogen-powered fuel cell trucks.

Nikola Corporation: A U.S.-based company focused on developing and manufacturing hydrogen-powered heavy-duty trucks.

Sunfire GmbH: A German company specializing in electrolysis technology for hydrogen production from renewable sources.

GenCell Energy Ltd.: An Israeli company specializing in hydrogen fuel cell power generators.

CNG (Clean Natural Gas) Services: An Australian company focused on building and operating hydrogen fueling stations.

Overall Competitive Scenario:

The competitive landscape of the hydrogen fueling station market is anticipated to remain dynamic and fragmented in the coming years. As the market matures and the demand for FCEVs rises, a trend towards consolidation may emerge, with larger players acquiring smaller companies to broaden their reach and market share. Additionally, new regulations and policies from governments aimed at promoting hydrogen fuel cell technology are likely to influence the competitive landscape.

By actively participating in shaping the future of hydrogen infrastructure, these companies can ensure their long-term success in this rapidly growing market.

Industry Developments and Latest Updates:

Air Products and Chemicals, Inc. (11/28/2023): Air Products announced the launch of a new hydrogen fueling station in California capable of dispensing both compressed and liquid hydrogen, a first in the state.

Linde plc (10/26/2023): Linde partnered with Shell to explore hydrogen infrastructure development in Europe, focusing on building fueling stations and developing new technologies for hydrogen production and distribution.

Nel ASA (09/19/2023): Nel acquired Hydrogenics Corporation, a leading provider of hydrogen fuel cell technology, strengthening its position in the hydrogen fueling station market.

McPhy Energy S.A. (08/02/2023): McPhy signed a contract with ENGIE to supply hydrogen refueling stations for a fleet of hydrogen buses in France, marking McPhy's largest single order to date.