Growth in the Pharmaceutical Sector

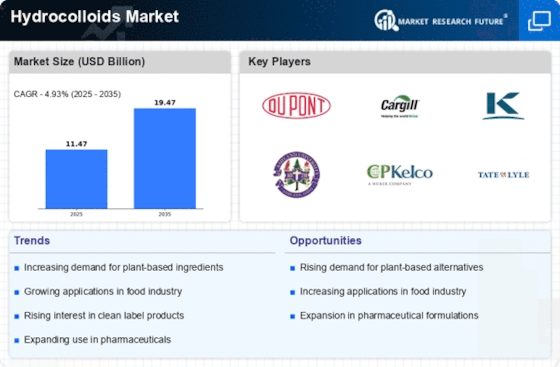

The Hydrocolloids Market is also benefiting from increased utilization in the pharmaceutical sector. Hydrocolloids Market are employed in drug formulations, wound dressings, and controlled-release systems due to their biocompatibility and ability to retain moisture. The pharmaceutical segment is projected to witness a growth rate of around 5% annually, driven by advancements in drug delivery systems and the rising prevalence of chronic diseases. This growth is indicative of the expanding role of hydrocolloids in healthcare applications, which enhances their significance within the Hydrocolloids Market. As pharmaceutical companies continue to innovate, the demand for specialized hydrocolloid formulations is expected to rise.

Rising Awareness of Health Benefits

The Hydrocolloids Market is experiencing a surge in consumer awareness regarding the health benefits associated with hydrocolloids. These substances are known for their potential to improve digestive health, enhance satiety, and regulate blood sugar levels. As consumers increasingly seek functional foods that offer health advantages, the demand for hydrocolloids is likely to grow. Market data indicates that products containing hydrocolloids are becoming more prevalent in health-focused segments, such as gluten-free and low-calorie foods. This trend suggests that manufacturers in the Hydrocolloids Market may need to emphasize the health benefits of their products to capture the attention of health-conscious consumers.

Increasing Demand for Natural Ingredients

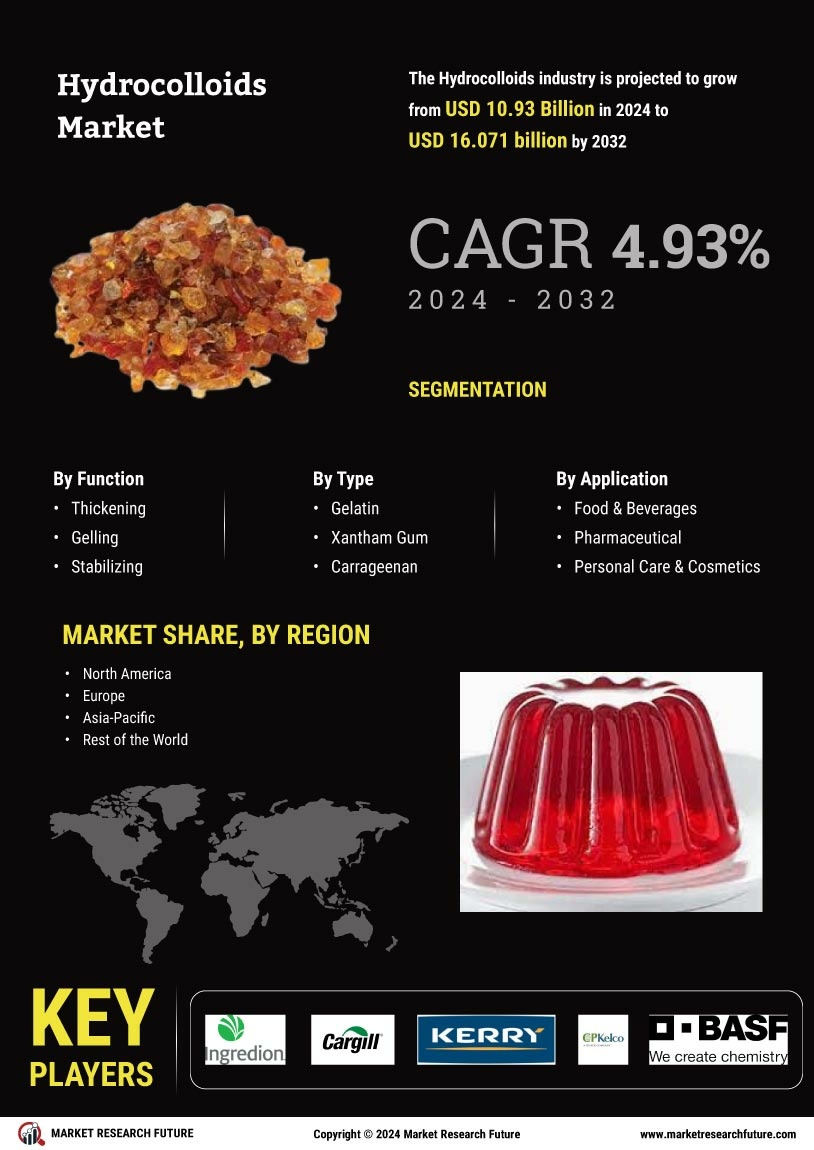

The Hydrocolloids Market is experiencing a notable shift towards natural ingredients, driven by consumer preferences for clean label products. As health-conscious consumers become more aware of food additives, the demand for hydrocolloids derived from natural sources is likely to rise. This trend is reflected in the market data, which indicates that the natural hydrocolloids segment is projected to grow at a compound annual growth rate of approximately 6% over the next five years. Manufacturers are responding by reformulating products to include natural hydrocolloids, thereby enhancing their market appeal. This shift not only aligns with consumer expectations but also positions companies favorably within the Hydrocolloids Market, as they adapt to evolving dietary trends.

Expansion of Food and Beverage Applications

The Hydrocolloids Market is witnessing an expansion in applications across the food and beverage sector. Hydrocolloids Market are increasingly utilized for their thickening, gelling, and stabilizing properties, which are essential in various products such as sauces, dressings, and dairy items. Market analysis suggests that the food segment accounts for over 60% of the total hydrocolloids consumption, indicating a robust demand. Furthermore, the rise in convenience foods and ready-to-eat meals is likely to propel the use of hydrocolloids, as manufacturers seek to improve texture and shelf life. This trend underscores the versatility of hydrocolloids, making them indispensable in the Hydrocolloids Market.

Technological Innovations in Hydrocolloid Production

The Hydrocolloids Market is poised for growth due to ongoing technological innovations in hydrocolloid production processes. Advances in extraction and processing techniques are enhancing the efficiency and quality of hydrocolloids, making them more accessible to manufacturers. For instance, the development of new extraction methods is likely to reduce production costs and improve yield, thereby benefiting the overall market. Additionally, innovations in formulation technology are enabling the creation of customized hydrocolloid solutions tailored to specific applications. This technological progress is expected to drive competitiveness within the Hydrocolloids Market, as companies strive to meet diverse consumer demands and improve product performance.