Growing Health Consciousness

The increasing awareness of health and wellness among consumers is driving the hydrocolloids market. As individuals seek healthier food options, the demand for natural and functional ingredients rises. Hydrocolloids, known for their thickening, gelling, and stabilizing properties, are increasingly utilized in low-calorie and sugar-free products. This trend is reflected in the market, where the demand for hydrocolloids is projected to grow at a CAGR of approximately 6% through 2027. The hydrocolloids market is adapting to this shift by offering products that align with consumer preferences for clean-label and health-oriented formulations.

Increased Focus on Sustainable Practices

Sustainability is becoming a central theme in the hydrocolloids market. As consumers and manufacturers alike prioritize eco-friendly practices, the demand for sustainably sourced hydrocolloids is increasing. This shift is evident in the growing interest in biodegradable and renewable hydrocolloid options. The hydrocolloids market is likely to see a rise in initiatives aimed at reducing environmental impact, such as sourcing raw materials from sustainable agriculture. This focus on sustainability not only meets consumer expectations but also aligns with regulatory trends favoring environmentally responsible practices.

Technological Advancements in Processing

Technological innovations in food processing are reshaping the hydrocolloids market. Advances in extraction and formulation techniques enable the development of new hydrocolloid products with enhanced functionalities. For instance, the use of enzymatic processes and high-pressure processing allows for the creation of hydrocolloids that meet specific consumer needs. This evolution in technology not only improves product quality but also expands the application range of hydrocolloids in various food products. The hydrocolloids market is likely to see increased investment in research and development to leverage these advancements.

Expansion of the Food and Beverage Sector

The robust growth of the food and beverage sector in the US is a significant driver for the hydrocolloids market. With the industry projected to reach a value of over $1 trillion by 2026, the demand for hydrocolloids is expected to increase correspondingly. These ingredients play a crucial role in enhancing texture, stability, and shelf-life of various food products. The hydrocolloids market benefits from this expansion as manufacturers seek to innovate and improve product formulations, thereby creating a favorable environment for hydrocolloid applications.

Rising Demand for Plant-Based Alternatives

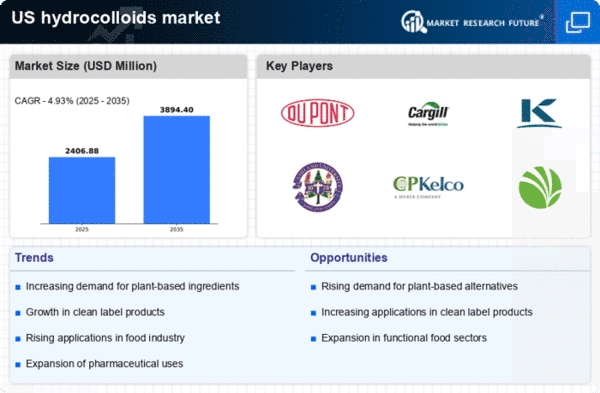

The shift towards plant-based diets is influencing the hydrocolloids market significantly. As consumers increasingly opt for vegan and vegetarian options, the demand for plant-derived hydrocolloids is on the rise. Ingredients such as agar, carrageenan, and pectin are gaining popularity due to their natural origins and functional benefits. This trend is supported by market data indicating that the plant-based food sector is expected to grow by over 20% by 2027. The hydrocolloids market is responding by focusing on sourcing and developing plant-based hydrocolloids to cater to this evolving consumer preference.