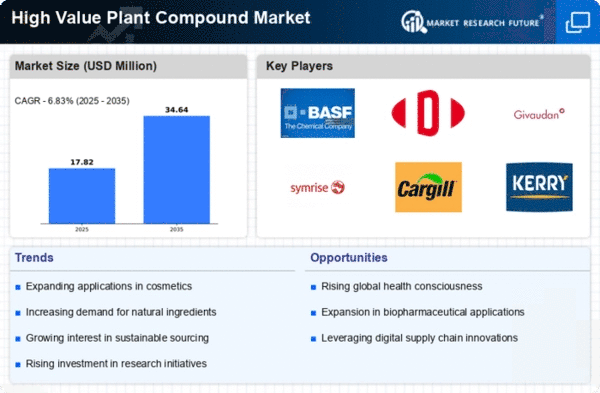

Market Growth Projections

The Global High Value Plant Compound Industry is projected to experience robust growth, with estimates indicating a market value of 62.3 USD Billion by 2035. This growth trajectory, characterized by a compound annual growth rate of 11.7% from 2025 to 2035, underscores the increasing recognition of the benefits associated with plant compounds. Factors such as rising health consciousness, demand for sustainable products, and advancements in extraction technologies are likely to contribute to this expansion. As the market evolves, stakeholders are expected to capitalize on emerging opportunities, driving further innovation and diversification within the industry.

Expansion of Nutraceuticals Market

The Global High Value Plant Compound Industry is significantly influenced by the expansion of the nutraceuticals market, which encompasses products derived from plants that provide health benefits beyond basic nutrition. This sector is projected to grow substantially, with increasing consumer interest in preventive healthcare and wellness. The market's growth is indicative of a broader trend towards holistic health solutions, with plant compounds being integral to this movement. By 2035, the industry is expected to reach 62.3 USD Billion, showcasing the potential of plant-derived nutraceuticals in addressing health concerns and enhancing quality of life.

Rising Demand for Natural Ingredients

The Global High Value Plant Compound Industry experiences a notable surge in demand for natural ingredients, driven by consumer preferences shifting towards organic and plant-based products. This trend is particularly evident in the food and beverage sector, where companies increasingly incorporate plant compounds for flavoring, coloring, and health benefits. As of 2024, the market is valued at 18.4 USD Billion, reflecting a growing awareness of the health advantages associated with natural ingredients. This shift not only enhances product appeal but also aligns with sustainability goals, further propelling the industry forward.

Regulatory Support for Natural Products

Regulatory support for natural products is becoming increasingly prominent in the Global High Value Plant Compound Industry, as governments recognize the importance of promoting sustainable and health-oriented products. Policies that encourage the use of plant-based ingredients in food, cosmetics, and pharmaceuticals are likely to enhance market growth. This regulatory environment not only facilitates market entry for new products but also assures consumers of safety and efficacy. As the industry continues to evolve, supportive regulations may provide a framework that fosters innovation and encourages the adoption of high-value plant compounds across various sectors.

Increased Research and Development Activities

Increased research and development activities within the Global High Value Plant Compound Industry are fostering innovation and expanding the range of applications for plant-derived compounds. Academic institutions and private enterprises are collaborating to explore the therapeutic potential of various plant compounds, leading to the discovery of new applications in pharmaceuticals, cosmetics, and food industries. This focus on R&D is essential for staying competitive in a rapidly evolving market, as it enables the development of novel products that meet consumer demands for efficacy and safety. The ongoing investment in R&D is likely to yield significant advancements in the coming years.

Technological Advancements in Extraction Methods

Technological advancements in extraction methods play a crucial role in the Global High Value Plant Compound Industry, enhancing the efficiency and yield of plant compounds. Innovations such as supercritical fluid extraction and ultrasonic extraction are becoming more prevalent, allowing for the isolation of high-purity compounds with minimal environmental impact. These advancements not only improve product quality but also reduce production costs, making plant compounds more accessible to manufacturers. As the industry evolves, these technologies are likely to drive growth and foster the development of new applications for plant compounds across various sectors.