Regulatory Compliance

Regulatory compliance is a significant factor influencing The US Sheet Molding Compound And Bulk Molding Compound Market. The US government has established stringent regulations regarding material safety, emissions, and waste management. Companies operating in this sector must adhere to these regulations to avoid penalties and ensure market access. Compliance with standards such as the Environmental Protection Agency (EPA) guidelines not only fosters consumer trust but also enhances product credibility. In 2025, it is anticipated that companies investing in compliance measures will experience a competitive advantage, as consumers increasingly prefer products that meet regulatory standards. This trend underscores the importance of maintaining high-quality manufacturing practices.

Automotive Industry Demand

The automotive industry remains a key driver for The US Sheet Molding Compound And Bulk Molding Compound Market. With the ongoing shift towards lightweight materials, manufacturers are increasingly utilizing sheet molding compounds (SMC) and bulk molding compounds (BMC) in vehicle production. These materials offer superior strength-to-weight ratios, contributing to improved fuel efficiency and performance. In 2025, the automotive sector is projected to account for over 40% of the total demand for SMC and BMC, reflecting a growing trend towards composite materials in vehicle design. As electric vehicles gain traction, the need for lightweight components is expected to surge, further propelling the market forward.

Sustainability Initiatives

The US Sheet Molding Compound And Bulk Molding Compound Market is increasingly influenced by sustainability initiatives. As environmental concerns gain prominence, manufacturers are compelled to adopt eco-friendly practices. This includes the development of bio-based resins and recyclable materials, which align with the growing demand for sustainable products. The US government has implemented various regulations aimed at reducing carbon footprints, which further drives the industry towards greener alternatives. In 2025, the market for sustainable composites was projected to reach approximately USD 1.5 billion, indicating a robust growth trajectory. Companies that prioritize sustainability not only enhance their brand image but also tap into a burgeoning consumer base that values environmental responsibility.

Technological Advancements

Technological advancements play a pivotal role in shaping The US Sheet Molding Compound And Bulk Molding Compound Market. Innovations in manufacturing processes, such as automated production lines and advanced molding techniques, have significantly improved efficiency and product quality. The integration of smart technologies, including IoT and AI, allows for real-time monitoring and optimization of production, reducing waste and enhancing operational efficiency. In 2025, the adoption of advanced manufacturing technologies is expected to increase productivity by up to 30%, thereby driving market growth. As companies invest in research and development, the introduction of new formulations and applications is likely to expand the market further, catering to diverse industries.

Market Expansion Opportunities

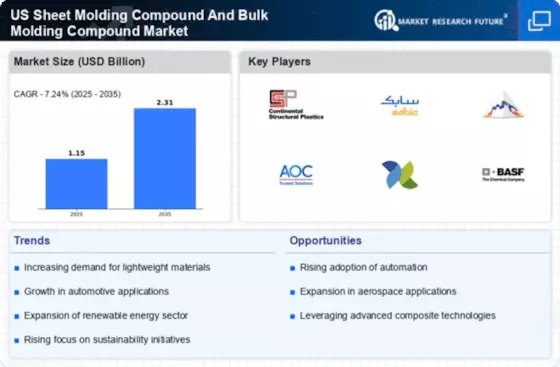

Market expansion opportunities present a compelling driver for The US Sheet Molding Compound And Bulk Molding Compound Market. As industries such as construction, aerospace, and consumer goods continue to evolve, the demand for advanced composite materials is expected to rise. The versatility of SMC and BMC allows for their application in various sectors, including infrastructure development and high-performance components. In 2025, the market is projected to grow at a CAGR of 5%, driven by increasing investments in infrastructure and technological innovations. Companies that strategically position themselves to capitalize on these opportunities are likely to enhance their market share and drive overall industry growth.