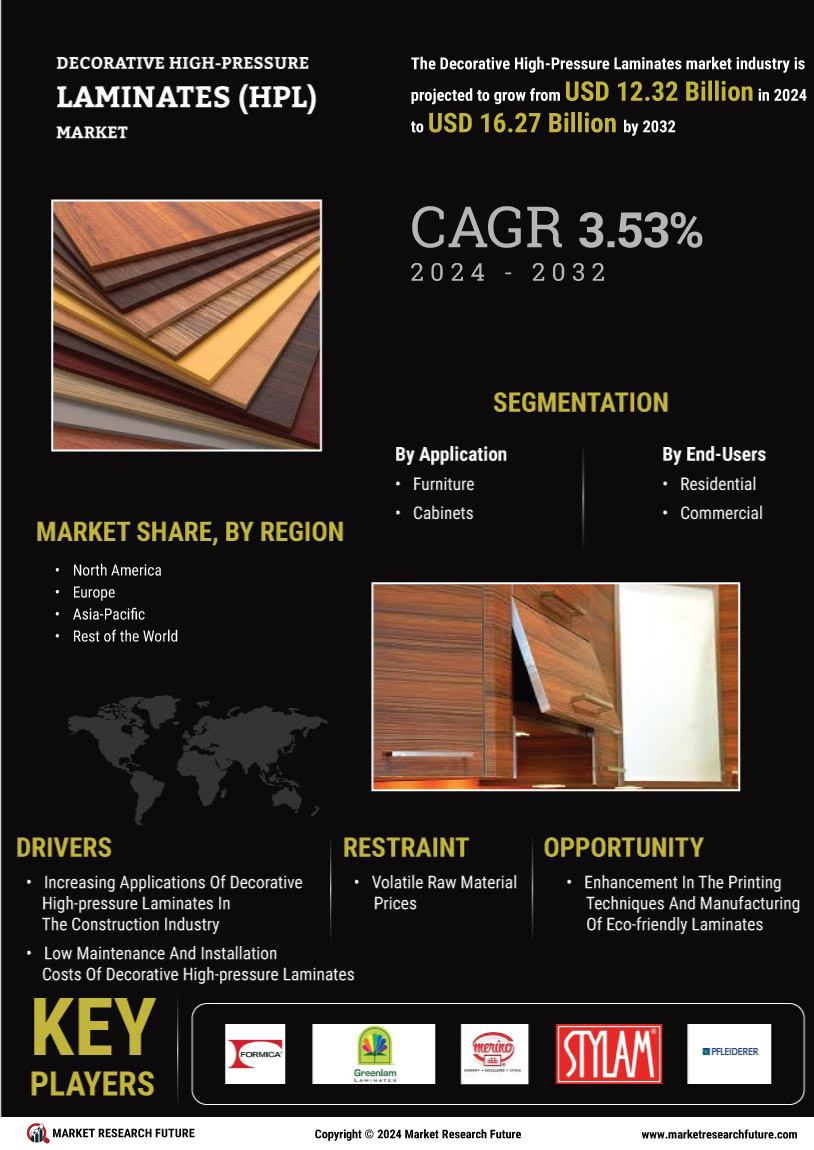

Rising Urbanization

Rising urbanization is significantly influencing the Decorative High-Pressure Laminates Market. As urban areas expand, there is an increasing demand for innovative building materials that can meet the needs of modern architecture. High-pressure laminates are favored for their versatility, aesthetic appeal, and durability, making them suitable for various applications, including furniture, wall panels, and flooring. The trend towards urban living is driving the construction of residential and commercial spaces, which in turn fuels the demand for decorative laminates. Market data indicates that regions experiencing rapid urban growth are likely to see a surge in laminate consumption, as developers and architects seek materials that combine functionality with design. This trend presents substantial opportunities for manufacturers to cater to the evolving needs of urban environments.

Sustainability Initiatives

The increasing emphasis on sustainability within the Decorative High-Pressure Laminates Market is driving demand for eco-friendly materials. Manufacturers are adopting sustainable practices, such as using recycled content and reducing waste during production. This shift aligns with consumer preferences for environmentally responsible products, which has been observed to influence purchasing decisions significantly. As a result, the market is witnessing a rise in the availability of laminates that meet stringent environmental standards. Furthermore, regulatory frameworks are evolving to support sustainable practices, thereby encouraging manufacturers to innovate and develop greener alternatives. The integration of sustainability into product offerings not only enhances brand reputation but also opens new avenues for market growth, as consumers increasingly seek out products that reflect their values.

Technological Advancements

Technological advancements are playing a crucial role in shaping the Decorative High-Pressure Laminates Market. Innovations in manufacturing processes, such as digital printing and advanced surface treatments, are enhancing the aesthetic appeal and durability of laminates. These technologies enable manufacturers to produce high-quality products that meet the evolving demands of consumers. Additionally, the integration of smart technologies into laminate production is expected to streamline operations and reduce costs. Market analysis suggests that companies investing in cutting-edge technology are likely to gain a competitive edge, as they can offer superior products at competitive prices. Furthermore, advancements in technology are facilitating the development of laminates with enhanced performance characteristics, such as improved resistance to scratches and stains, thereby broadening their application scope.

Growth in the Furniture Industry

The growth in the furniture industry is a key driver for the Decorative High-Pressure Laminates Market. As consumer preferences shift towards stylish and functional furniture, high-pressure laminates are increasingly being utilized for their aesthetic versatility and durability. The furniture sector is witnessing a surge in demand for innovative designs that incorporate laminate finishes, appealing to both residential and commercial markets. Market data suggests that the furniture industry is projected to expand, thereby creating a favorable environment for laminate manufacturers. This growth is further supported by trends in interior design that favor modern and sleek finishes, which high-pressure laminates can provide. Consequently, the symbiotic relationship between the furniture industry and the decorative laminates market is likely to foster continued growth and innovation.

Customization and Personalization

Customization and personalization are emerging as pivotal trends within the Decorative High-Pressure Laminates Market. Consumers are increasingly seeking unique designs that reflect their individual tastes and preferences. This demand for tailored solutions has prompted manufacturers to offer a wider range of colors, textures, and finishes. The ability to customize laminates allows for greater creativity in interior design, catering to both residential and commercial sectors. Market data indicates that companies providing personalized options are likely to capture a larger share of the market, as consumers are willing to invest in products that resonate with their personal style. This trend not only enhances customer satisfaction but also fosters brand loyalty, as consumers are more inclined to return to brands that offer bespoke solutions.