Advancements in Pump Technology

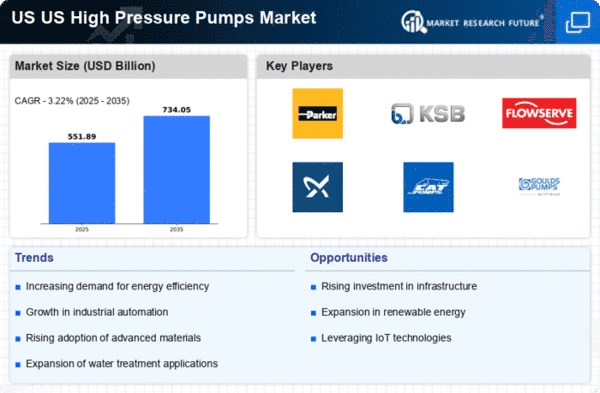

Technological innovation plays a crucial role in shaping the US High Pressure Pumps Market. Recent advancements in pump design, materials, and control systems have led to the development of more efficient and reliable high-pressure pumps. For instance, the introduction of smart pumps equipped with IoT capabilities allows for real-time monitoring and predictive maintenance, reducing downtime and operational costs. In 2025, the market for technologically advanced pumps is projected to grow by 15%, driven by the increasing demand for automation and efficiency across various sectors. This trend suggests that companies investing in cutting-edge pump technologies are likely to gain a competitive edge in the evolving market landscape.

Increased Focus on Water Management

Water management has emerged as a pivotal concern in the US High Pressure Pumps Market, particularly in light of growing water scarcity issues. High-pressure pumps are essential for various applications, including irrigation, wastewater treatment, and industrial processes. The US government has implemented several policies aimed at promoting efficient water usage, which in turn boosts the demand for high-pressure pumps. In 2025, the water management sector represented around 25% of the market share, indicating a significant opportunity for growth. As municipalities and industries seek to optimize water resources, the adoption of high-pressure pumps is expected to rise, further propelling the market forward.

Growing Demand in Oil and Gas Sector

The US High Pressure Pumps Market is experiencing a notable surge in demand, particularly from the oil and gas sector. As exploration and production activities intensify, the need for high-pressure pumps to facilitate the extraction and transportation of hydrocarbons becomes increasingly critical. In 2025, the oil and gas industry accounted for approximately 30% of the total high-pressure pump market in the US, reflecting a robust growth trajectory. This trend is likely to continue as companies invest in advanced pumping technologies to enhance efficiency and reduce operational costs. Furthermore, the ongoing shift towards unconventional oil and gas extraction methods, such as hydraulic fracturing, necessitates the use of high-pressure pumps, thereby driving market expansion.

Regulatory Compliance and Safety Standards

The US High Pressure Pumps Market is significantly influenced by stringent regulatory compliance and safety standards. Industries such as oil and gas, chemicals, and food processing are subject to rigorous regulations that mandate the use of high-quality, reliable pumping solutions. Compliance with these standards not only ensures operational safety but also enhances product quality. In 2025, approximately 20% of the market growth can be attributed to the need for compliance with environmental and safety regulations. As companies strive to meet these requirements, the demand for high-pressure pumps that adhere to regulatory standards is expected to rise, thereby driving market growth.

Expansion of Manufacturing and Industrial Sectors

The expansion of the manufacturing and industrial sectors in the US is a key driver of the High Pressure Pumps Market. As industries such as automotive, pharmaceuticals, and food processing continue to grow, the demand for high-pressure pumps to support various manufacturing processes is likely to increase. In 2025, the manufacturing sector accounted for nearly 35% of the high-pressure pump market, underscoring its importance. This growth is fueled by the need for efficient fluid transfer, mixing, and processing in manufacturing operations. Consequently, the ongoing industrial expansion presents a substantial opportunity for high-pressure pump manufacturers to cater to the evolving needs of diverse industries.