Rising Demand for Eco-Friendly Packaging

The Herbal Toothcare Market is increasingly influenced by the rising demand for eco-friendly packaging solutions. As environmental concerns gain prominence, consumers are becoming more discerning about the packaging of the products they purchase. This trend is particularly relevant in the oral care sector, where traditional plastic packaging is being scrutinized for its environmental impact. Market data suggests that brands adopting sustainable packaging solutions can enhance their appeal to eco-conscious consumers, potentially leading to increased market share. The shift towards biodegradable and recyclable materials is not merely a trend but appears to be a fundamental change in consumer expectations. As a result, companies within the Herbal Toothcare Market are likely to invest in innovative packaging technologies that align with sustainability goals, thereby reinforcing their commitment to environmental stewardship.

Shift Towards Natural and Organic Products

The Herbal Toothcare Market is witnessing a significant shift towards natural and organic products, driven by changing consumer preferences. As more individuals seek to avoid synthetic ingredients, the demand for herbal toothcare solutions is on the rise. This trend is supported by market data indicating that the organic personal care market, which includes oral care products, is expected to reach USD 25 billion by 2027. Consumers are increasingly drawn to products that are free from harmful chemicals, which positions herbal toothpastes and mouth rinses as attractive options. This shift not only reflects a desire for safer products but also aligns with broader lifestyle choices that prioritize sustainability and health. Consequently, brands within the Herbal Toothcare Market are likely to focus on sourcing high-quality, organic ingredients to cater to this growing consumer base.

Increasing Consumer Awareness of Oral Health

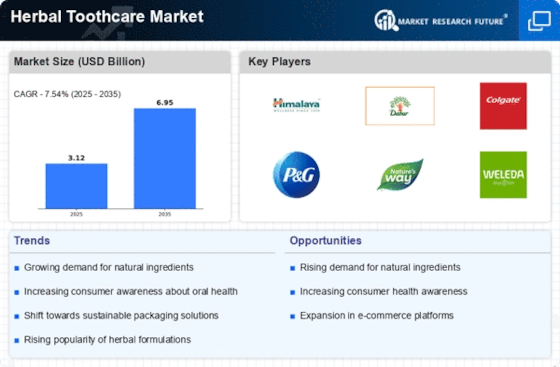

The Herbal Toothcare Market is experiencing a notable surge in consumer awareness regarding oral health. As individuals become more informed about the implications of oral hygiene on overall health, there is a growing inclination towards products that offer natural solutions. This trend is reflected in the increasing demand for herbal toothpastes and mouthwashes, which are perceived as safer alternatives to conventional products laden with synthetic chemicals. Market data indicates that the herbal segment is projected to grow at a compound annual growth rate of approximately 8% over the next five years, suggesting a robust shift in consumer preferences towards herbal formulations. This heightened awareness is likely to drive innovation and expansion within the Herbal Toothcare Market, as brands strive to meet the evolving needs of health-conscious consumers.

Influence of Social Media and Online Reviews

The Herbal Toothcare Market is significantly shaped by the influence of social media and online reviews. In an era where digital platforms dominate consumer interactions, the way products are marketed and perceived has transformed dramatically. Consumers often rely on social media influencers and peer reviews to guide their purchasing decisions, particularly in the realm of personal care. This trend is underscored by data indicating that nearly 70% of consumers trust online reviews as much as personal recommendations. Consequently, brands within the Herbal Toothcare Market are increasingly leveraging social media marketing strategies to engage with potential customers and build brand loyalty. The ability to showcase product benefits and customer testimonials through these platforms can enhance visibility and drive sales, making social media a critical component of marketing strategies in this industry.

Growing Interest in Holistic Health Approaches

The Herbal Toothcare Market is benefiting from the growing interest in holistic health approaches among consumers. As individuals seek to adopt comprehensive wellness strategies, there is a notable inclination towards products that support overall health, including oral care. This trend is reflected in the increasing popularity of herbal toothpastes that incorporate traditional remedies and natural ingredients known for their therapeutic properties. Market data suggests that the holistic health market is expanding, with consumers willing to invest in products that align with their health philosophies. This shift towards holistic health not only influences purchasing behavior but also encourages brands within the Herbal Toothcare Market to innovate and diversify their product offerings. By integrating holistic principles into their formulations, companies can cater to the evolving preferences of health-conscious consumers.