Rising Consumer Demand for Natural Remedies

The Global Herbal Medicine Market Industry experiences a notable surge in consumer demand for natural remedies, driven by a growing awareness of the potential side effects associated with synthetic pharmaceuticals. As individuals increasingly seek holistic and preventive healthcare solutions, the market is projected to reach 100.1 USD Billion in 2024. This shift towards herbal alternatives reflects a broader trend towards wellness and self-care, with consumers favoring products perceived as safer and more effective. The inclination towards natural ingredients is further supported by the increasing availability of herbal products in mainstream retail channels, enhancing accessibility and consumer confidence.

Expansion of E-commerce Platforms for Herbal Products

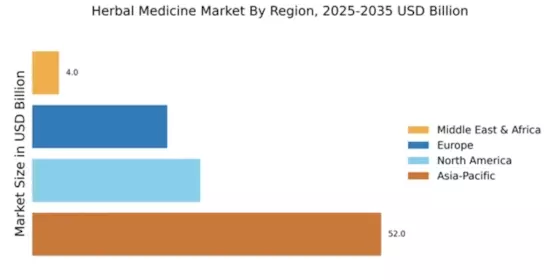

The Global Herbal Medicine Market Industry is significantly influenced by the expansion of e-commerce platforms dedicated to herbal products. The convenience of online shopping, coupled with the increasing penetration of the internet, allows consumers to access a wider range of herbal remedies than ever before. This trend is particularly relevant in regions where traditional retail options may be limited. E-commerce platforms often provide detailed product information and customer reviews, which can enhance consumer trust and facilitate informed purchasing decisions. As a result, the market is poised for substantial growth, reflecting the changing dynamics of consumer behavior in the digital age.

Growing Interest in Preventive Healthcare and Wellness

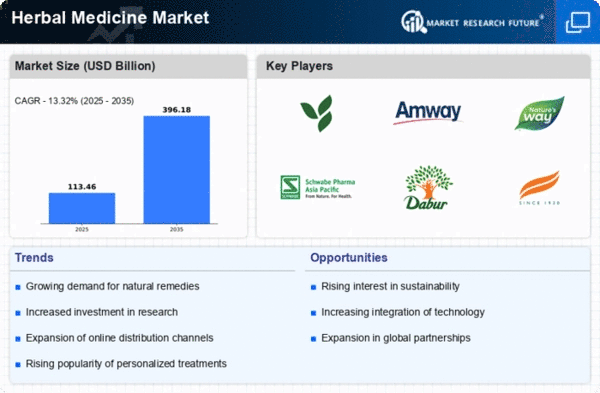

The Global Herbal Medicine Market Industry is experiencing a shift towards preventive healthcare and wellness, as consumers become more proactive about their health. This trend is characterized by an increasing preference for herbal remedies that promote overall well-being rather than merely treating ailments. The rise of wellness culture, coupled with the influence of social media and health influencers, has contributed to the popularity of herbal products. This growing interest is likely to drive market expansion, with projections indicating a potential market size of 396.2 USD Billion by 2035. The focus on preventive health aligns with the broader movement towards sustainable and holistic living.

Increased Investment in Herbal Research and Development

The Global Herbal Medicine Market Industry benefits from increased investment in research and development aimed at exploring the therapeutic potential of herbal products. Governments and private entities are allocating resources to study the pharmacological properties of various herbs, which may lead to the discovery of new applications and formulations. This focus on scientific validation is crucial for enhancing the credibility of herbal medicine. As a result, the market is expected to experience a compound annual growth rate of 13.32% from 2025 to 2035. Such investments not only promote innovation but also contribute to the overall growth and sustainability of the herbal sector.

Growing Acceptance of Herbal Medicine in Mainstream Healthcare

The Global Herbal Medicine Market Industry is witnessing a gradual acceptance of herbal medicine within mainstream healthcare systems. Healthcare professionals are increasingly recognizing the potential benefits of integrating herbal remedies into conventional treatment protocols. This trend is evidenced by the establishment of collaborative practices between herbalists and medical practitioners, which may enhance patient outcomes. As a result, the market is anticipated to grow significantly, with projections indicating a rise to 396.2 USD Billion by 2035. This acceptance is likely to be bolstered by ongoing research validating the efficacy of various herbal treatments, thereby fostering trust among both practitioners and patients.