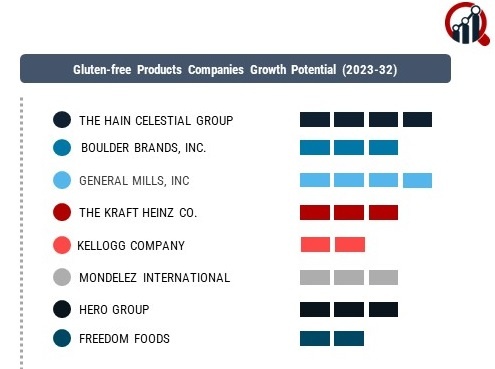

Top Industry Leaders in the Gluten Free Products Market

Key Companies in the gluten-free products market are listed Below

- The Hain Celestial Group Inc.

- Boulder Brands, Inc

- General Mills Inc.

- The Kraft Heinz Company

- Kellogg’s Company

- Glutamate

- Hero Group AG

Come 2023, On Tuesday, the CSIR-Central Food Technological Research Institute (CFTRI) unveiled three new technologies here as part of the "One Week One Lab" (OWOL) initiative. The institute has declared that it had created twenty new technologies, all of which will be made available in tandem with the initiative. There are still thirteen technologies that can be launched before July 7, which is the last day of OWOL. In India, a cake mix without gluten and rusks with added fibre were introduced.

Dr Schär, an Italian gluten-free food company, plans to invest €12 million ($13.2 million) in biscuit production at its Dreihausen, Germany, manufacturing site in 2023. As the "core product of the site," biscuit manufacture is what the company hopes to enhance, according to Dr Schär.

As part of the agreement, the business will install new biscuit cream measuring equipment, which it claims will enhance ingredient dosage and cut down on waste.

Earlier this year, the Full of Beans gluten-free brand was acquired by Arva Flour Mills, the oldest continuously running water-powered commercial flour mill in North America, which was established in 2023. Arva plans to introduce the gluten-free range under the Arva Flour Mills name soon.