Rising Health Consciousness

The US Gluten Free Products Market is experiencing a notable surge in demand driven by an increasing awareness of health and wellness among consumers. Many individuals are adopting gluten-free diets not only due to celiac disease but also as a preventive measure against potential health issues. According to recent surveys, approximately 30% of the US population is actively seeking gluten-free options, indicating a shift towards healthier eating habits. This trend is further supported by the growing prevalence of gluten sensitivity, which has prompted food manufacturers to innovate and expand their gluten-free product lines. As a result, the US Gluten Free Products Market is likely to witness sustained growth as more consumers prioritize their health and seek out gluten-free alternatives.

Expansion of Retail Channels

The US Gluten Free Products Market is benefiting from the expansion of retail channels that cater specifically to gluten-free consumers. Major grocery chains and specialty health food stores are increasingly dedicating shelf space to gluten-free products, making them more accessible to a broader audience. In 2025, it was reported that gluten-free product sales in supermarkets reached over $1 billion, reflecting a significant increase in consumer access. Additionally, online retail platforms are playing a crucial role in this expansion, allowing consumers to conveniently purchase gluten-free products from the comfort of their homes. This diversification of retail channels is likely to enhance the visibility and availability of gluten-free options, further driving growth in the US Gluten Free Products Market.

Innovative Product Development

The US Gluten Free Products Market is witnessing a wave of innovative product development as manufacturers strive to meet the evolving preferences of health-conscious consumers. Companies are increasingly investing in research and development to create gluten-free alternatives that do not compromise on taste or texture. For instance, the introduction of gluten-free snacks, baked goods, and ready-to-eat meals has expanded the market significantly. In 2025, the gluten-free snack segment alone accounted for approximately 25% of total gluten-free sales in the US, highlighting the demand for convenient and flavorful options. This focus on innovation is likely to attract new consumers to the market, thereby bolstering the growth of the US Gluten Free Products Market.

Increased Awareness of Food Allergies

The US Gluten Free Products Market is also influenced by the rising awareness of food allergies and intolerances among consumers. As more individuals are diagnosed with gluten-related disorders, there is a growing demand for gluten-free products that cater to these specific dietary needs. Educational campaigns and advocacy from health organizations have played a pivotal role in informing the public about the importance of gluten-free diets for those affected. In 2025, it was estimated that over 3 million Americans were diagnosed with celiac disease, further driving the need for gluten-free options. This heightened awareness is likely to sustain the growth trajectory of the US Gluten Free Products Market as consumers seek safe and suitable food choices.

Regulatory Support and Labeling Standards

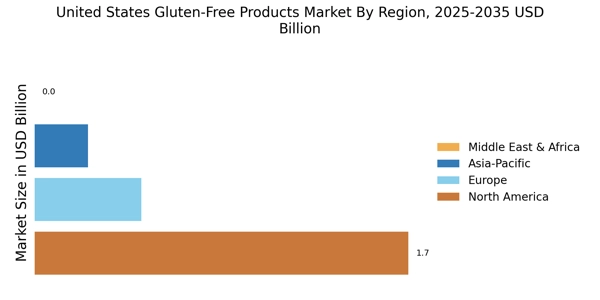

The US Gluten Free Products Market is supported by regulatory frameworks and labeling standards that enhance consumer confidence in gluten-free products. The Food and Drug Administration (FDA) has established clear guidelines for labeling gluten-free foods, ensuring that consumers can make informed choices. This regulatory support has not only increased the credibility of gluten-free claims but has also encouraged manufacturers to adhere to strict quality standards. As of 2025, the gluten-free market in the US was valued at approximately $5 billion, reflecting the positive impact of these regulations on consumer trust. This regulatory environment is likely to continue fostering growth in the US Gluten Free Products Market as more consumers seek reliable gluten-free options.