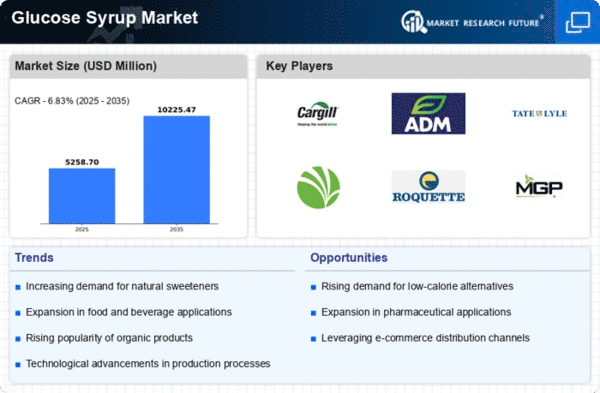

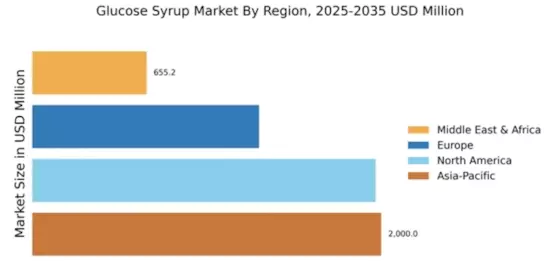

North America : Market Leader in Glucose Syrup

North America continues to lead the glucose syrup market, holding a significant share of 1967.25 million in 2024. The region's growth is driven by increasing demand in the food and beverage sector, particularly for sweeteners and thickening agents. Regulatory support for food safety and quality standards further enhances market stability, encouraging innovation and investment in production technologies. The competitive landscape is robust, with key players like Cargill, Archer Daniels Midland, and Ingredion dominating the market. The U.S. remains the largest contributor, supported by advanced manufacturing capabilities and a strong distribution network. The presence of major companies fosters a competitive environment, driving product development and market expansion.

Europe : Emerging Market with Growth Potential

Europe's glucose syrup market is valued at 1300.0 million, reflecting a growing demand for natural sweeteners and clean-label products. The region is witnessing a shift towards healthier food options, prompting manufacturers to innovate and adapt. Regulatory frameworks, such as the EU's food safety regulations, are pivotal in shaping market dynamics, ensuring quality and consumer safety. Leading countries like Germany, France, and the UK are at the forefront of this growth, with companies such as Tate & Lyle and Südzucker AG playing significant roles. The competitive landscape is characterized by a mix of established players and emerging startups, fostering innovation and collaboration. The focus on sustainability and organic products is expected to drive further growth in the coming years.

Asia-Pacific : Rapid Growth and Demand Surge

The Asia-Pacific region is experiencing rapid growth in the glucose syrup market, with a market size of 2000.0 million. This surge is driven by rising consumer demand for processed foods and beverages, coupled with increasing disposable incomes. Regulatory support for food safety and quality standards is also a key driver, promoting the use of glucose syrup in various applications. Countries like China, India, and Japan are leading the charge, with significant contributions from local and international players. The competitive landscape features major companies such as Ingredion and Roquette Freres, which are expanding their operations to meet the growing demand. The focus on innovation and product diversification is expected to enhance market growth in the region.

Middle East and Africa : Emerging Market with Untapped Potential

The Middle East and Africa (MEA) glucose syrup market is valued at 655.24 million, showcasing untapped potential for growth. The region is witnessing an increase in demand for glucose syrup in the food and beverage industry, driven by urbanization and changing consumer preferences. Regulatory frameworks are evolving, promoting food safety and quality, which is crucial for market expansion. Countries like South Africa and the UAE are emerging as key players in this market, with local manufacturers and international companies exploring opportunities. The competitive landscape is gradually developing, with a focus on innovation and product offerings. As the region continues to grow, investments in production capabilities and distribution networks will be essential for capturing market share.