Advancements in Technology and Simulation

Technological advancements are playing a pivotal role in shaping the Geomechanics Software Market. The integration of sophisticated simulation tools and modeling techniques enhances the accuracy and efficiency of geotechnical analyses. Innovations such as 3D modeling and real-time data processing allow engineers to visualize complex geological conditions and predict potential challenges. The market for simulation software is expected to expand, with estimates suggesting a growth rate of around 6% annually. These advancements not only improve the reliability of geomechanical assessments but also facilitate better decision-making in project planning and execution. As technology continues to evolve, the Geomechanics Software Market is likely to benefit from increased adoption of these advanced tools, leading to more effective and sustainable engineering solutions.

Regulatory Compliance and Safety Standards

The Geomechanics Software Market is significantly influenced by the need for regulatory compliance and adherence to safety standards. Governments and regulatory bodies are imposing stringent guidelines to ensure the safety and stability of geotechnical structures. This has led to an increased reliance on geomechanics software, which provides essential tools for risk assessment and compliance verification. The market is witnessing a growing trend towards software solutions that facilitate compliance with local and international regulations. As industries strive to meet these standards, the demand for geomechanics software is likely to rise. Reports indicate that the market for compliance-related software is expected to grow, reflecting the increasing importance of safety in engineering practices. Thus, the Geomechanics Software Market is poised for growth as it aligns with regulatory requirements.

Rising Demand for Infrastructure Development

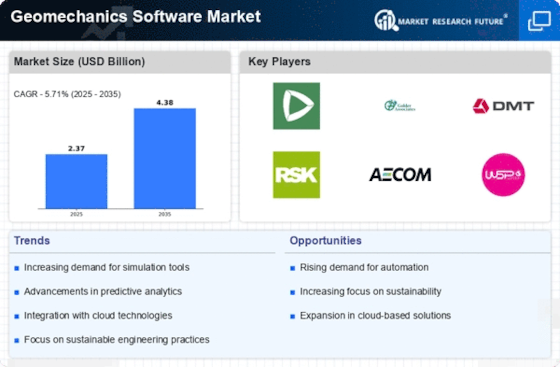

The Geomechanics Software Market is experiencing a surge in demand due to the increasing need for infrastructure development. Governments and private sectors are investing heavily in construction projects, including roads, bridges, and tunnels. This trend is driven by urbanization and population growth, which necessitate the expansion of existing infrastructure. According to recent data, the construction sector is projected to grow at a compound annual growth rate of approximately 5% over the next few years. As a result, the demand for geomechanics software, which aids in the analysis and design of geotechnical structures, is likely to rise significantly. This software enables engineers to assess soil behavior and stability, ensuring that infrastructure projects are safe and efficient. Consequently, the Geomechanics Software Market is poised for substantial growth as it supports these critical development initiatives.

Growing Awareness of Environmental Sustainability

The Geomechanics Software Market is increasingly influenced by the growing awareness of environmental sustainability. As industries face pressure to minimize their ecological footprint, geomechanics software plays a crucial role in assessing the environmental impact of construction projects. This software enables engineers to evaluate soil and groundwater conditions, ensuring compliance with environmental regulations. The market is witnessing a shift towards solutions that prioritize sustainability, with a projected increase in demand for eco-friendly geotechnical practices. Reports indicate that the sustainable construction market is expected to grow significantly, potentially reaching a value of over 300 billion dollars by 2027. This trend underscores the importance of integrating environmental considerations into geomechanical analyses, thereby driving growth in the Geomechanics Software Market.

Increased Investment in Mining and Resource Extraction

The Geomechanics Software Market is benefiting from increased investment in mining and resource extraction activities. As the demand for minerals and natural resources rises, companies are seeking advanced geomechanical solutions to optimize their operations. Geomechanics software assists in evaluating the stability of mine slopes, predicting ground behavior, and ensuring the safety of mining operations. The mining sector is projected to grow at a rate of approximately 4% annually, which is likely to drive the demand for specialized geomechanics tools. This software not only enhances operational efficiency but also mitigates risks associated with resource extraction. Consequently, the Geomechanics Software Market is expected to expand as it caters to the evolving needs of the mining sector.