Gdpr Services Size

Market Size Snapshot

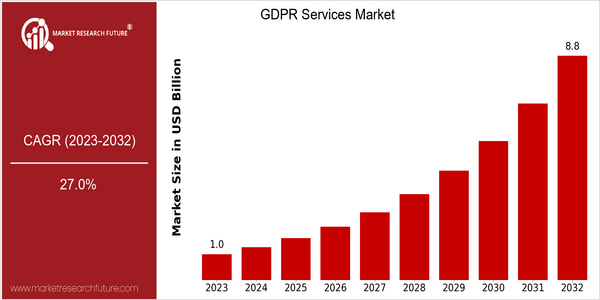

| Year | Value |

|---|---|

| 2023 | USD 1.021 Billion |

| 2032 | USD 8.754 Billion |

| CAGR (2022-2032) | 27.0 % |

Note – Market size depicts the revenue generated over the financial year

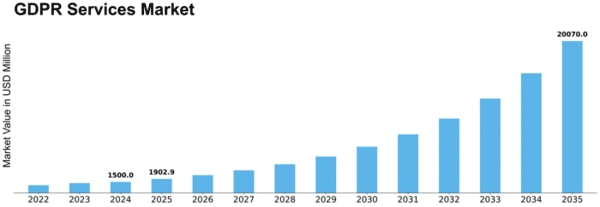

The GDPR Services Market is currently valued at around $ 1,021 million in 2023, and is expected to grow at a CAGR of around 6% over the forecast period, reaching a market size of $ 8,754 million by 2032. This remarkable growth, a CAGR of 27.0% from 2022 to 2032, is attributed to the increasing importance of data protection and compliance in a rapidly evolving digital landscape. With organizations around the world tackling the complexity of the regulations, the demand for specialized services that ensure compliance and mitigate risks is rising. The growing awareness of the need for data privacy, among both consumers and organizations, and the increasing number of data breaches, have increased the need for stricter compliance measures. The integration of artificial intelligence and machine learning into data management processes is also playing a key role in enhancing the capabilities of organizations to comply with the GDPR. These factors, along with the growing number of companies, are driving the GDPR Services Market. Key players, such as IBM, Microsoft, and TrustArc, are focusing on developing new products and services and forming strategic alliances to strengthen their presence in the market. These initiatives, not only reflect the growing importance of GDPR services in the future of data governance, but also highlight the need for further market expansion.

Regional Market Size

Regional Deep Dive

The GDPR Services Market is experiencing significant growth in various regions, driven by an increased awareness of the need for data privacy and compliance with data protection requirements. In North America, the market is characterized by a strong focus on regulatory compliance and the presence of many technology companies investing in GDPR-related services. In Europe, the market is characterized by stricter regulations and a high demand for compliance solutions. The Asia-Pacific region is experiencing a growing interest in GDPR services as countries in the region adopt similar data protection laws. The Middle East and Africa are gradually realizing the importance of data privacy, and the GDPR services market is growing. Latin America is beginning to align its data protection regulations with GDPR standards, which is an opportunity for service providers.

Europe

- The European Data Protection Board (EDPB) has issued new guidelines that clarify the application of GDPR, influencing how organizations implement compliance measures.

- Companies like SAP and Accenture are innovating with AI-driven GDPR compliance tools, which are expected to streamline processes and reduce costs for businesses.

Asia Pacific

- Countries like Japan and South Korea are adopting GDPR-like regulations, which is driving demand for GDPR compliance services in the region.

- Local firms such as NTT Data are partnering with European companies to develop GDPR compliance solutions tailored to the unique needs of Asian markets.

Latin America

- Brazil's General Data Protection Law (LGPD) has created a parallel demand for GDPR services, as companies seek to comply with both regulations.

- Local tech firms are increasingly collaborating with European GDPR service providers to enhance their offerings and ensure compliance with international standards.

North America

- The California Consumer Privacy Act (CCPA) has prompted many organizations in North America to enhance their GDPR compliance efforts, leading to increased demand for GDPR services.

- Major tech companies like Microsoft and IBM are expanding their GDPR service offerings, focusing on cloud solutions that ensure compliance and data protection.

Middle East And Africa

- The UAE's introduction of the Data Protection Law in 2020 has spurred interest in GDPR services, as businesses seek to align with international standards.

- Organizations like the Dubai International Financial Centre (DIFC) are promoting GDPR compliance as part of their regulatory framework, encouraging firms to invest in data protection services.

Did You Know?

“As of 2023, over 80% of organizations in Europe have reported investing in GDPR compliance solutions, highlighting the critical importance of data protection in the region.” — European Commission Report on GDPR Compliance

Segmental Market Size

The GDPR Services Market is experiencing steady growth as organizations continue to prioritise data protection and compliance. The main drivers are the rising demand for privacy and security from consumers, the increasingly stringent regulatory environment in Europe and beyond, and the increasing complexity of data management in digital environments. Companies are now obliged to adopt GDPR-compliant practices in order to avoid hefty fines and retain the trust of their customers. The current market is in a mature stage of adoption, with market leaders such as IBM and Microsoft offering comprehensive solutions. The European Union and North America are leading the way in implementing robust frameworks to ensure compliance. Data mapping, consent management, and incident response are the main use cases, particularly in the finance and health care industries, where data sensitivity is at a critical level. The growing trend towards data ethics and the growing use of remote working are accelerating the demand for GDPR services. Artificial intelligence and machine learning are also influencing the market’s development, as they help companies automate compliance and improve security.

Future Outlook

The market for GDPR services will be growing at a rapid rate from 2023 to 2032, growing from $1.021 billion to $8.754 billion. The main reasons for this growth are the increasing complexity of data protection regulations and the rising demand for compliance solutions in various industries. Moreover, as organizations continue to focus on data security and data privacy, the penetration of GDPR services into industries such as health care, finance and e-commerce, where data sensitivity is particularly high, will increase. In 2032, more than 70% of companies in these industries will have integrated GDPR compliance solutions into their operational frameworks, significantly improving their data governance capabilities. Artificial intelligence and machine learning will play a major role in shaping the future of the GDPR services market. These technologies will enable more efficient data management and compliance processes, enabling organizations to automate the verification of compliance and simplify reporting. Furthermore, the ongoing evolution of data protection legislation around the world will further increase the demand for GDPR services as companies strive to comply with not only European regulations but also the emerging data protection laws in other regions. And this will give rise to a variety of new services, such as privacy-as-a-service and comprehensive data protection platforms, which will cater to the diverse needs of companies in the digital age.

Leave a Comment