Growing Awareness of Eye Health

There is a marked increase in public awareness regarding eye health within the GCC Ophthalmic Drugs Devices Market. Campaigns promoting regular eye examinations and preventive care are gaining traction, leading to higher patient engagement in eye health management. This heightened awareness is likely to result in increased demand for ophthalmic drugs and devices, as individuals seek timely interventions for eye conditions. Moreover, educational programs and partnerships with healthcare providers are fostering a culture of proactive eye care, which could further stimulate market growth. As a consequence, the market may witness a shift towards preventive solutions, with an anticipated increase in the adoption of advanced diagnostic tools and therapeutic devices.

Government Initiatives and Funding

The GCC Ophthalmic Drugs Devices Market benefits from various government initiatives aimed at improving healthcare services. Countries within the GCC are increasingly allocating funds to enhance eye care facilities and promote research and development in ophthalmology. For instance, the Saudi Vision 2030 initiative emphasizes the importance of healthcare advancements, including eye care. Such initiatives are likely to foster collaboration between public and private sectors, leading to the introduction of innovative ophthalmic drugs and devices. Additionally, government support for local manufacturers may stimulate the growth of the market, as it encourages the production of cost-effective solutions tailored to regional needs. This strategic focus on healthcare is expected to drive the market forward, potentially increasing its value to USD 1.5 billion by 2028.

Rising Prevalence of Eye Disorders

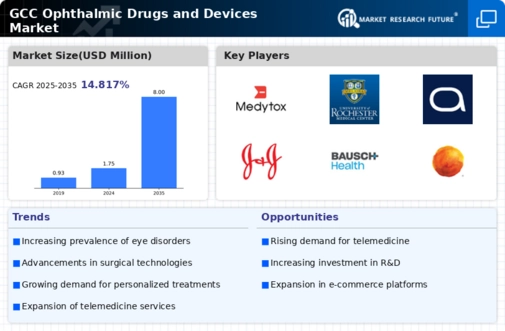

The GCC Ophthalmic Drugs Devices Market is experiencing a notable surge in demand due to the increasing prevalence of eye disorders such as diabetic retinopathy, glaucoma, and age-related macular degeneration. According to regional health statistics, the incidence of these conditions is projected to rise significantly, driven by factors such as an aging population and lifestyle changes. This trend necessitates the development and distribution of advanced ophthalmic drugs and devices, thereby propelling market growth. Furthermore, the GCC governments are investing in healthcare infrastructure, which is likely to enhance access to eye care services and promote the adoption of innovative ophthalmic solutions. As a result, the market is expected to expand, with a compound annual growth rate (CAGR) of approximately 7% over the next five years.

Rising Investment in Healthcare Infrastructure

The GCC Ophthalmic Drugs Devices Market is poised for growth due to substantial investments in healthcare infrastructure across the region. Governments are prioritizing the enhancement of healthcare facilities, which includes the establishment of specialized eye care centers equipped with state-of-the-art ophthalmic devices. This investment is expected to improve access to quality eye care services, thereby increasing the demand for ophthalmic drugs and devices. Additionally, partnerships with international healthcare organizations may facilitate the transfer of knowledge and technology, further bolstering the market. As healthcare infrastructure continues to develop, the GCC is likely to become a hub for ophthalmic innovation, attracting both local and international players to invest in the market.

Technological Innovations in Ophthalmic Devices

The GCC Ophthalmic Drugs Devices Market is significantly influenced by rapid technological advancements in ophthalmic devices. Innovations such as telemedicine, artificial intelligence, and minimally invasive surgical techniques are transforming the landscape of eye care. These technologies not only enhance the accuracy of diagnoses but also improve patient outcomes, thereby driving demand for advanced ophthalmic solutions. The integration of smart devices and mobile applications for eye health monitoring is also gaining popularity, reflecting a shift towards personalized care. As a result, the market is likely to expand, with an increasing number of healthcare providers adopting these technologies to enhance service delivery and patient satisfaction.