Government Initiatives and Funding

The UK government has been actively supporting the ophthalmic sector through various initiatives and funding programs, which significantly impact the UK Ophthalmic Drugs Devices Market. The National Institute for Health Research (NIHR) and other governmental bodies provide grants for research and development in ophthalmology, encouraging innovation and the introduction of new products. Additionally, the UK government has implemented policies aimed at improving access to eye care services, which indirectly boosts the demand for ophthalmic drugs and devices. By fostering a conducive environment for research and development, these initiatives are likely to enhance the market's growth trajectory, as they facilitate the introduction of novel therapies and technologies that address unmet medical needs.

Increasing Awareness and Education

There is a growing emphasis on eye health awareness and education within the UK, which is positively influencing the UK Ophthalmic Drugs Devices Market. Public health campaigns and educational programs aimed at informing individuals about the importance of regular eye examinations and early detection of eye diseases are gaining traction. Organizations such as the Royal National Institute of Blind People (RNIB) are actively involved in promoting eye health, which encourages individuals to seek timely medical attention. This heightened awareness is likely to lead to an increase in the diagnosis of eye conditions, subsequently driving demand for ophthalmic drugs and devices. As patients become more informed about available treatment options, the market is expected to benefit from a surge in the utilization of innovative ophthalmic solutions.

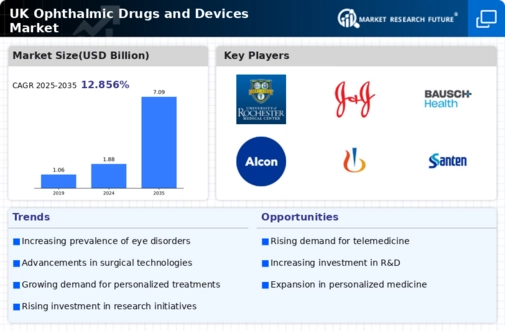

Rising Prevalence of Eye Disorders

The UK Ophthalmic Drugs Devices Market is experiencing growth due to the increasing prevalence of eye disorders such as glaucoma, diabetic retinopathy, and age-related macular degeneration. According to the National Health Service (NHS), the number of individuals diagnosed with these conditions is on the rise, leading to a greater demand for effective treatment options. This trend is further supported by an aging population, as older adults are more susceptible to various eye diseases. Consequently, pharmaceutical companies and device manufacturers are focusing on developing innovative solutions to address these challenges, thereby driving market expansion. The growing awareness of eye health among the public also contributes to the demand for ophthalmic drugs and devices, as individuals seek timely interventions to preserve their vision.

Rising Investment in Research and Development

Investment in research and development (R&D) within the UK ophthalmic sector is on the rise, significantly impacting the UK Ophthalmic Drugs Devices Market. Pharmaceutical companies and medical device manufacturers are allocating substantial resources to develop new therapies and technologies aimed at addressing various eye conditions. This trend is supported by collaborations between academic institutions and industry players, fostering innovation and accelerating the development of novel products. The UK government also plays a role by providing funding and incentives for R&D initiatives. As a result, the market is likely to witness the introduction of groundbreaking ophthalmic drugs and devices that enhance patient care and treatment outcomes, ultimately contributing to the overall growth of the industry.

Technological Innovations in Ophthalmic Devices

Technological advancements play a pivotal role in shaping the UK Ophthalmic Drugs Devices Market. Innovations such as minimally invasive surgical techniques, advanced imaging technologies, and smart contact lenses are revolutionizing the way eye conditions are diagnosed and treated. For instance, the introduction of optical coherence tomography (OCT) has significantly improved the accuracy of diagnosing retinal diseases. Furthermore, the integration of artificial intelligence in diagnostic tools enhances the efficiency of eye examinations. These technological breakthroughs not only improve patient outcomes but also attract investments from both public and private sectors, fostering a competitive landscape. As a result, the market is likely to witness a surge in the adoption of cutting-edge ophthalmic devices, ultimately benefiting patients and healthcare providers alike.